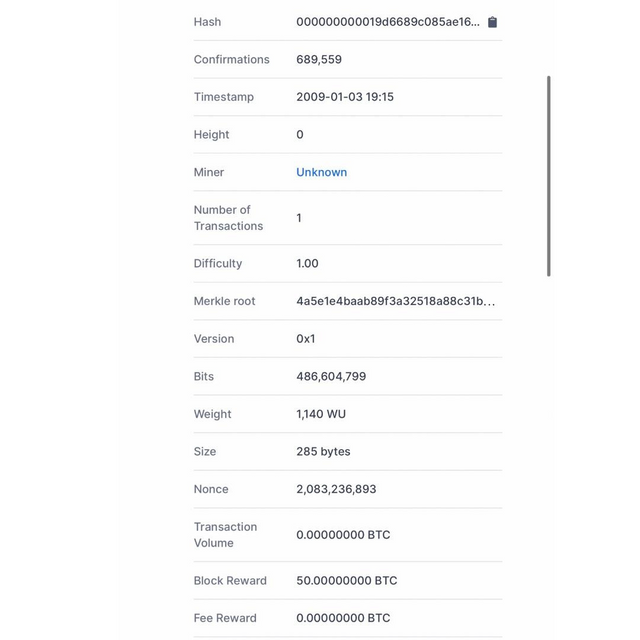

The project begins with a brief history of bitcoin, starting with its launch in 2009 by a person or group of people known as Satoshi Nakamoto. The main events that shaped the course of development of this digital currency are highlighted.

How Bitcoin works:

The technological foundations of bitcoin's work are explained, including blockchain technology and how security and transparency are achieved through it. This also includes mining operations and how bitcoins are issued and traded.

The impact of bitcoin on the economy:

Emphasis is placed on the impact of bitcoin on the national and global economies, including issues related to inflation and monetary policies. Examples are given of countries that have adopted Bitcoin or have explored its applications in their economic system.

Challenges and opportunities:

The project addresses the challenges faced by bitcoin, such as price fluctuations and security issues. At the same time, opportunities for the development and application of blockchain technology in various fields are reviewed.

Future developments:

They talk about the expected future developments of the bitcoin project, including the developments of technologies and technology surrounding it, and how in the future this could affect the global financial system.

Conclusion:

The article concludes with a summary of the most important points of the project with the formation and impact on the digital world and the global economy. The conclusions also indicate the importance of understanding this project and following its developments for those who want to stay up to date with digital innovations.

How Bitcoin works:

The technological foundations of bitcoin's work are explained, including blockchain technology and how security and transparency are achieved through it. This also includes mining operations and how bitcoins are issued and traded.

The impact of bitcoin on the economy:

Emphasis is placed on the impact of bitcoin on the national and global economies, including issues related to inflation and monetary policies. Examples are given of countries that have adopted Bitcoin or have explored its applications in their economic system.

Challenges and opportunities:

The project addresses the challenges faced by bitcoin, such as price fluctuations and security issues. At the same time, opportunities for the development and application of blockchain technology in various fields are reviewed.

Future developments:

They talk about the expected future developments of the bitcoin project, including the developments of technologies and technology surrounding it, and how in the future this could affect the global financial system.

Conclusion:

The article concludes with a summary of the most important points of the project with the formation and impact on the digital world and the global economy. The conclusions also indicate the importance of understanding this project and following its developments for those who want to stay up to date with digital innovations.

The project begins with a brief history of bitcoin, starting with its launch in 2009 by a person or group of people known as Satoshi Nakamoto. The main events that shaped the course of development of this digital currency are highlighted.

How Bitcoin works:

The technological foundations of bitcoin's work are explained, including blockchain technology and how security and transparency are achieved through it. This also includes mining operations and how bitcoins are issued and traded.

The impact of bitcoin on the economy:

Emphasis is placed on the impact of bitcoin on the national and global economies, including issues related to inflation and monetary policies. Examples are given of countries that have adopted Bitcoin or have explored its applications in their economic system.

Challenges and opportunities:

The project addresses the challenges faced by bitcoin, such as price fluctuations and security issues. At the same time, opportunities for the development and application of blockchain technology in various fields are reviewed.

Future developments:

They talk about the expected future developments of the bitcoin project, including the developments of technologies and technology surrounding it, and how in the future this could affect the global financial system.

Conclusion:

The article concludes with a summary of the most important points of the project with the formation and impact on the digital world and the global economy. The conclusions also indicate the importance of understanding this project and following its developments for those who want to stay up to date with digital innovations.

0 Comments

0 Shares

8060 Views