Every successful business is done and achieved by certain group of people.

There is no limit to what you can achieve.

Cryptocurrency is one of the fastest growing digital currency that has brought an easy strategy to the way of making money.

Say no to starvation and loans, start your own investment today.

Sacrifice the little funds and time you have today and so you can enjoy your upcoming decades.

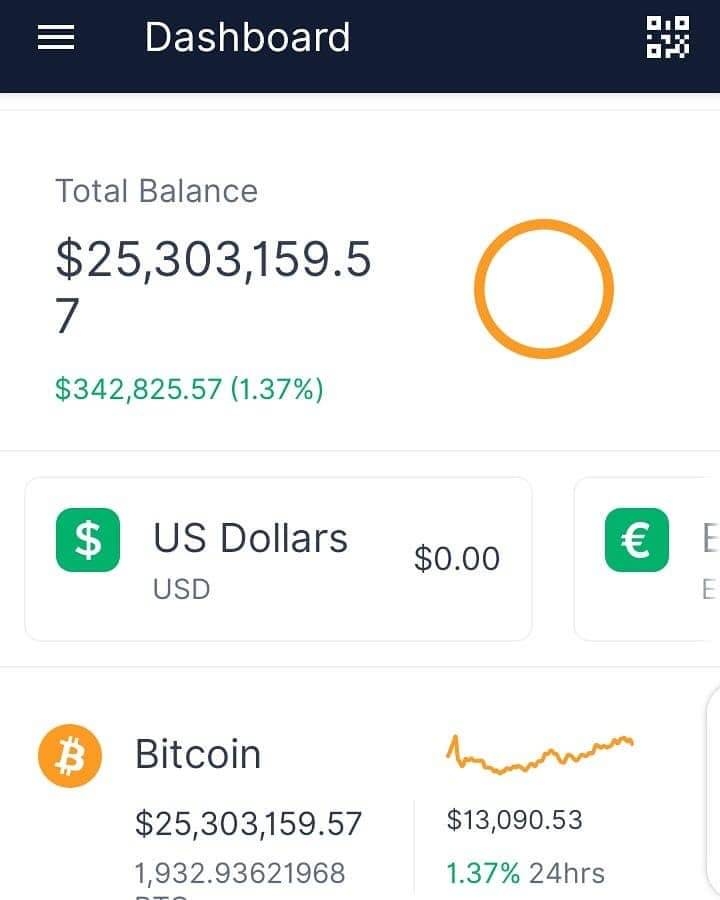

Start Bitcoin investment or some days from now you will wish that you've started earlier.

#Cryptocurrency????????????

#Profits????????????????????

#cryptoinvestment #bitcoinmining #bitcointrading #bitcoininvestment #bitcoin #cryptoEvery successful business is done and achieved by certain group of people.

There is no limit to what you can achieve.

Cryptocurrency is one of the fastest growing digital currency that has brought an easy strategy to the way of making money.

Say no to starvation and loans, start your own investment today.

Sacrifice the little funds and time you have today and so you can enjoy your upcoming decades.

Start Bitcoin investment or some days from now you will wish that you've started earlier.

#Cryptocurrency????????????

#Profits????????????????????

#cryptoinvestment

#bitcoinmining

#bitcointrading

#bitcoininvestment

#bitcoin

#crypto