PromptPro

Introduction

Question

Are you tired of language models generating repetitive and uninspired responses?

Just like a musician needs a variety of instruments to create a diverse range of melodies, language models require diverse prompts to generate unique and creative responses.

Meet Devin, a Generative Prompt Engineer (GPE) who revolutionizes language models by crafting prompts that encourage diverse and dynamic responses.

"Thanks to Devin's prompt engineering, our language model's responses are more creative and engaging than ever before." - Anissa Thomas

In this blog post, we'll explore how Generative Prompt Engineering can revolutionize language models and how skilled engineers like Devin can make it happen.

Ready to take your language model usage to the next level? Keep reading to learn more about the power of Generative Prompt Engineering (GPE).

Generative Prompt Engineering is a technique used to generate high-quality text using natural language processing (NLP) models.

Question

How can we generate more diverse and interesting responses from language models?

GPE can help by designing prompts that encourage language models to generate more diverse and creative responses. For example, GPE might experiment with using more open-ended prompts, providing more context or background information, or asking more thought-provoking questions.

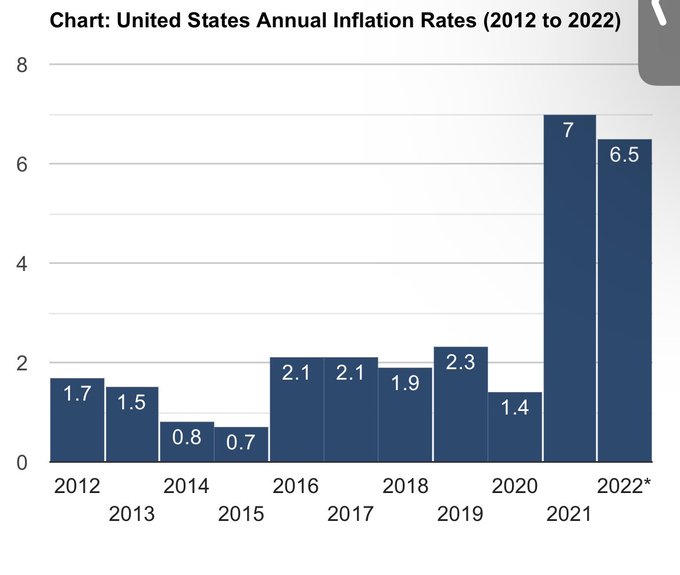

The Impact of AI on the Future of Work

As artificial intelligence continues to advance, its impact on the labor market is becoming increasingly important to consider.

Diverse and creative responses in language models are critical because they enable the model to produce a range of unique and interesting outputs that are not limited to a single response. Language models that are capable of generating diverse and creative responses have a greater chance of producing outputs that are relevant and engaging to the user, thereby improving the user experience. In this section, we will discuss the importance of diverse and creative responses in language models.

Avoiding Repetitive Response

One of the primary benefits of diverse and creative responses in language models is the ability to avoid repetitive responses. Language models that produce the same or similar responses repeatedly can quickly become boring and uninteresting to the user. This can lead to a lack of engagement and a decrease in user satisfaction. By generating diverse and creative responses, language models can keep the user engaged and interested in the conversation.

Providing a Range of Options

Another benefit of diverse and creative responses in language models is the ability to provide a range of options to the user. This can be especially useful in situations where the user is looking for information or assistance. For example, a language model that is capable of providing multiple solutions to a problem can help the user find the solution that works best for them. By providing a range of options, language models can also help to build trust with the user by demonstrating that they are capable of providing useful and relevant information.

Personalization

Diverse and creative responses in language models can also help to personalize the conversation with the user. By generating responses that are tailored to the user's interests and preferences, language models can create a more engaging and enjoyable conversation. This can also lead to increased user satisfaction and loyalty.

Enhancing Creativity

Finally, diverse and creative responses in language models can help to enhance creativity. Language models that are capable of generating unique and interesting responses can inspire the user to think more creatively and explore new ideas. This can be especially useful in situations where the user is looking for inspiration or new perspectives.

Overall, diverse and creative responses in language models are critical because they can help to avoid repetitive responses, provide a range of options, personalize the conversation, and enhance creativity. By generating unique and interesting responses, language models can keep the user engaged and interested in the conversation, leading to increased user satisfaction and loyalty. As language models continue to evolve, the ability to generate diverse and creative responses will become even more important.

Why You Should Learn About Generative Prompt Engineering

Discover how Generative Prompt Engineering can help you create innovative content, save time and costs, personalize your communication with customers, and advance your career.

Generative Prompt Engineering is an emerging field that combines natural language processing, machine learning, and creativity to generate new and original content based on prompts or cues. The field has been gaining popularity in recent years due to its potential to automate content creation and enable personalized communication with customers. In this blog, we will discuss in detail why you should learn about Generative Prompt Engineering.

Innovative Content Creation

Generative Prompt Engineering is an innovative approach to content creation that can help you create unique and engaging content. Unlike traditional content creation methods, which often involve a lot of manual effort, Generative Prompt Engineering can produce a large amount of content in a short amount of time. The content generated through Generative Prompt Engineering can be used for a variety of purposes, including marketing, advertising, and content creation.

Time and Cost Efficiency

Generative Prompt Engineering can save you time and money by automating content creation tasks that would otherwise be done manually. This can be especially useful if you work in an industry where content creation is a frequent and time-consuming task. With Generative Prompt Engineering, you can produce content faster and at a lower cost, freeing up time and resources to focus on other aspects of your business.

Personalization

Generative Prompt Engineering can help you create personalized content tailored to your audience's interests and preferences. Personalization is becoming increasingly important in marketing and advertising as customers expect a more personalized experience. With Generative Prompt Engineering, you can create content that is relevant and engaging to your audience, which can lead to increased engagement and customer loyalty.

Career Opportunities

Generative Prompt Engineering is an emerging field with a growing demand for skilled professionals. Learning about Generative Prompt Engineering can help you stay ahead of the curve and open up new career opportunities. As more businesses start to adopt Generative Prompt Engineering, there will be a growing need for experts who can develop and implement these technologies.

Advancements in Artificial Intelligence

Generative Prompt Engineering is a prime example of the advancements being made in artificial intelligence and machine learning. Learning about Generative Prompt Engineering can help you understand the potential of these technologies and stay up-to-date with the latest developments. As the field continues to evolve, there will be more opportunities to apply these technologies to new areas and industries.

Learning about Generative Prompt Engineering can provide you with a range of benefits, from innovative content creation and time and cost efficiency to personalization, career opportunities, and a better understanding of artificial intelligence and machine learning. If you are interested in pursuing a career in the tech industry or looking to enhance your skills, learning about Generative Prompt Engineering is a great place to start.

Why Generative Prompt Engineering is an Essential Skill for Content Creators

In a world where content is king, Generative Prompt Engineering can help you create unique, personalized, and engaging content quickly and efficiently.

Generative Prompt Engineering is an innovative approach to content creation that combines natural language processing, machine learning, and creativity to generate new and original content based on prompts or cues. This field is becoming increasingly important as it has the potential to automate content creation and enable personalized communication with customers. Here are some reasons why content creators should learn about Generative Prompt Engineering:

Creating Unique and Engaging Content

Generative Prompt Engineering can help you create unique and engaging content that stands out from the competition. With traditional content creation methods, it can be challenging to come up with new and exciting ideas. Generative Prompt Engineering can produce a large amount of content in a short amount of time, allowing you to explore new ideas and produce content that is original and engaging. For example, if you're a social media marketer, you can use Generative Prompt Engineering to create unique and eye-catching social media posts that will capture your audience's attention.

Time and Cost Efficiency in Content Creation

Generative Prompt Engineering can save you time and money by automating content creation tasks that would otherwise be done manually. With Generative Prompt Engineering, you can produce content faster and at a lower cost, freeing up time and resources to focus on other aspects of your business. For example, if you're a blogger, you can use Generative Prompt Engineering to generate article topics and outlines, allowing you to spend more time researching and writing the actual content.

Personalization for Better Customer Engagement

Generative Prompt Engineering can help you create personalized content tailored to your audience's interests and preferences. Personalization is becoming increasingly important in marketing and advertising as customers expect a more personalized experience. With Generative Prompt Engineering, you can create content that is relevant and engaging to your audience, which can lead to increased engagement and customer loyalty. For example, if you're an email marketer, you can use Generative Prompt Engineering to generate personalized email subject lines and body text based on the recipient's preferences and behavior.

Career Opportunities in the Emerging Field of Generative Prompt Engineering

Generative Prompt Engineering is an emerging field with a growing demand for skilled professionals. Learning about Generative Prompt Engineering can help you stay ahead of the curve and make you a valuable asset to any company looking to improve their content creation process. There are a variety of career opportunities in this field, including positions in content creation, marketing, advertising, and technology. For example, companies like OpenAI and GPT-3 are actively seeking talented individuals with skills in Generative Prompt Engineering.

In full, Generative Prompt Engineering is an essential skill for content creators in today's digital age. It can help you create unique, personalized, and engaging content quickly and efficiently while also providing career opportunities in an emerging field. Whether you're a blogger, social media marketer, or email marketer, learning about Generative Prompt Engineering can help you take your content creation game to the next level.

Generative Prompt Engineering is an emerging field that combines natural language processing, machine learning, and creativity to generate new and original content based on prompts or cues. While the field is relatively new, it has its roots in a long history of research and development in natural language processing and machine learning.

A Moment in Time: Historical Context and Development of Generative Prompt Engineering

The development of natural language processing can be traced back to the 1950s, when researchers first began experimenting with computer algorithms that could understand and process human language. However, progress in this area was slow, and it wasn't until the 1990s that natural language processing began to gain wider attention and recognition.

During the 1990s, the focus of natural language processing research shifted towards statistical approaches and machine learning. This led to the development of algorithms that could analyze large datasets of text and identify patterns and relationships between words and phrases. These algorithms were used to build more sophisticated language models, which could be used to generate new text based on existing data.

In the early 2000s, this approach was further refined with the development of neural language models. These models used artificial neural networks to simulate the way the human brain processes language, and they were able to produce more natural-sounding text than earlier language models. This led to the development of applications like chatbots, virtual assistants, and automated customer service systems.

However, the text generated by these models was often generic and lacked creativity, leading researchers to explore new ways to generate more engaging and original content. This led to the emergence of Generative Prompt Engineering as a field of study and research.

Today, Generative Prompt Engineering is an area of active research and development, with new techniques and approaches being developed and tested all the time. One of the most important recent developments has been the use of generative adversarial networks (GANs) to generate text. GANs are a type of machine learning algorithm that can generate new text based on a set of prompts, and they are becoming increasingly popular in the field of natural language processing.

Overall, the historical context and development of Generative Prompt Engineering can be traced back to a long history of research and development in natural language processing and machine learning. The emergence of this field represents a new frontier in creative content generation, and it holds the potential to revolutionize the way we communicate and interact with technology.

How GPE Can Help in Creating Diverse and Creative Responses

Designing Prompts for Diverse and Creative Responses in GPE

The key to generating diverse and creative responses in language models lies in the design of prompts. In this segment, we will discuss how Generative Prompt Engineers (GPE) can design prompts to encourage language models to produce unique and engaging content.

Understanding the Importance of Prompts

The first step in designing effective prompts is understanding their importance in generating diverse and creative responses in language models. A prompt serves as a cue or stimulus for the language model to generate content. The quality and specificity of the prompt can greatly influence the type of response the model generates. A well-designed prompt can lead to a range of diverse and creative responses, while a poorly designed prompt may limit the model's output.

Using Open-Ended Prompts

Open-ended prompts are a great way to encourage language models to produce diverse and creative responses. These prompts give the model the freedom to generate content without constraints. For example, consider the prompt "Describe your ideal vacation." This prompt allows the language model to generate a variety of responses, from tropical beach getaways to adventurous hiking trips.

Incorporating Novelty and Surprise

Incorporating novelty and surprise into prompts can also lead to more diverse and creative responses. This can be achieved by using prompts that are unexpected or unusual. For example, consider the prompt "Write a story about a giraffe who can fly." This prompt introduces an unexpected element that can lead to unique and engaging responses.

Focusing on Specific Details

Focusing on specific details in prompts can also encourage language models to generate more diverse and creative responses. Specific details can provide context and constraints for the language model, while still allowing for flexibility and creativity. For example, consider the prompt "Describe a day in the life of a firefighter." This prompt provides specific details about the subject matter, while still allowing for a range of responses.

Incorporating User Feedback

Incorporating user feedback can also be a valuable tool in designing effective prompts. User feedback can help GPEs understand what types of prompts lead to the most diverse and creative responses. For example, a GPE can analyze user responses to a set of prompts and use that information to refine and improve their prompt design in the future.

In full, effective prompt design is crucial for generating diverse and creative responses in language models. By using open-ended prompts, incorporating novelty and surprise, focusing on specific details, and incorporating user feedback, GPEs can design prompts that encourage language models to produce unique and engaging content.

Techniques for designing effective prompts in Generative Prompt Engineering

By using open-ended prompts, contextual prompts, and thought-provoking questions, Generative Prompt Engineers can encourage language models to generate diverse and creative responses that can be used for a variety of purposes, including marketing, content creation, and personal communication.

In order to generate diverse and creative responses, Generative Prompt Engineers employ a variety of techniques to design prompts that encourage language models to produce unique and engaging content. Here are some examples of techniques that are commonly used.

Open-Ended Prompts

One technique that Generative Prompt Engineers use is to create open-ended prompts. These prompts encourage language models to generate responses that are not limited by a specific set of parameters. By giving the model more freedom to explore different possibilities, the resulting content can be more diverse and creative. For example, an open-ended prompt might ask the model to generate a story that begins with the phrase "Once upon a time."

Contextual Prompts

Another technique that can be effective is to provide more context in the prompt. This can help guide the language model towards a specific topic or idea while still allowing for creativity. For instance, a prompt asking the model to generate a recipe for a vegan chili would provide more context than simply asking for a recipe, which could lead to a wider range of responses.

Thought-Provoking Questions

Generative Prompt Engineers can also design prompts that provoke thought and inspire the language model to generate more unique and interesting responses. These types of prompts can be especially effective in generating content that is engaging and thought-provoking for the audience. For example, a prompt asking the model to generate a conversation between two characters who have just met on a deserted island could lead to a range of creative responses that explore themes such as survival, isolation, and human connection.

Key Skills for a Generative Prompt Engineer

The ideal candidate for this role will have a strong technical background, excellent problem-solving skills, and the ability to work both independently and as part of a team. Additionally, excellent communication, organization, and time management skills are crucial in order to ensure projects are completed on time and on budget.

Technical Background

A Generative Prompt Engineer must have a strong technical background in natural language processing, machine learning, and programming languages such as Python. Understanding the fundamentals of these fields is essential for designing effective prompts and developing high-quality models. Familiarity with software development tools and platforms is also important for creating and testing models.

Problem-Solving Skills

Problem-solving skills are critical for a Generative Prompt Engineer, as they must be able to identify and address issues that arise during the model development process. They must also be able to analyze data and adjust models to improve their performance. Strong problem-solving skills allow a Generative Prompt Engineer to create models that are accurate, efficient, and effective.

Communication

Effective communication is crucial for a Generative Prompt Engineer, as they often work as part of a team that includes developers, designers, and other stakeholders. Clear communication helps to ensure that everyone is on the same page and working towards the same goals. Additionally, communicating technical concepts to non-technical stakeholders is essential for gaining buy-in and support for projects.

Organization

A Generative Prompt Engineer must be highly organized, as they are often working on multiple projects simultaneously. They must be able to prioritize tasks and manage their time effectively to meet deadlines and ensure that projects are completed on time and within budget. Strong organizational skills allow a Generative Prompt Engineer to be efficient and effective in their work.

Time Management

Time management is essential for a Generative Prompt Engineer, as they must balance multiple competing priorities and deadlines. Effective time management allows them to ensure that they are meeting deadlines, managing their workload, and delivering high-quality work. It also helps them to stay on top of emerging trends and technologies, which is critical in this rapidly evolving field.

Overall, A Generative Prompt Engineer requires a diverse skill set that includes technical knowledge, problem-solving skills, communication, organization, and time management skills. These skills are essential for developing and implementing effective models that generate high-quality, diverse and creative responses.

The Importance of Language Skills in Generative Prompt Engineering

Parsing, Syntax, and Grammar Skills

Tip

Language skills, including parsing, syntax, and grammar, are essential for creating effective prompts in Generative Prompt Engineering, enabling the generation of diverse and creative responses."

Generative Prompt Engineering (GPE) is an interdisciplinary field that combines natural language processing, machine learning, and creativity to generate new and original content based on prompts or cues. As we discussed earlier, GPE is an emerging field with a growing demand for skilled professionals. While technical background, problem-solving skills, communication, organization, and time management skills are important in this field, language skills are also key to success.

In this section, we will discuss the importance of parsing, syntax, and grammar skills in GPE. These language skills are essential for creating effective prompts that can generate diverse and creative responses.

Parsing Skills

Parsing refers to the process of analyzing a sentence to understand its grammatical structure. In GPE, understanding the grammatical structure of a prompt can help the engineer create prompts that are grammatically correct and easy for the language model to understand. For example, consider the prompt "The cat sat on the mat." By parsing this sentence, a GPE can identify the subject ("the cat"), the verb ("sat"), and the object ("the mat"). This understanding can then be used to create similar prompts that are grammatically correct and easy for the language model to understand.

Syntax Skills

Syntax refers to the arrangement of words and phrases to create well-formed sentences. In GPE, understanding syntax is important for creating prompts that are clear and easy to understand. For example, consider the prompt "Write a story about a man with a dog who goes on an adventure." By using proper syntax, a GPE can create a clear and concise prompt that is easy for the language model to understand and generate a creative response.

Grammar Skills

Grammar refers to the rules that govern the use of language. In GPE, understanding grammar is important for creating prompts that are grammatically correct and use proper word choice. For example, consider the prompt "Write a poem about nature." By using proper grammar, a GPE can create a prompt that is clear and easy for the language model to understand, while also encouraging the generation of a creative and engaging response.

Language skills play a critical role in Generative Prompt Engineering as they enable GPEs to create effective prompts that can generate diverse and creative responses. Parsing, syntax, and grammar skills are particularly important for GPEs as they enable them to create prompts that are grammatically correct, clear, and easy for the language model to understand.

These language skills also allow GPEs to identify and address any issues that may arise during the model development process. For example, if a language model generates responses that are not grammatically correct or do not make sense, a GPE can use their parsing, syntax, and grammar skills to identify the issue and adjust the model accordingly.

Furthermore, language skills are essential for creating prompts that are engaging and thought-provoking. By using proper grammar and syntax, GPEs can create prompts that are clear and easy to understand, while also encouraging the generation of creative and engaging responses. For example, a prompt like "Write a story about a man with a dog who goes on an adventure" is more engaging and thought-provoking than a prompt like "Write a story about a man who goes on an adventure."

Lastly, language skills are crucial for GPEs to create effective prompts and ensure the successful completion of projects on time and within budget. By having strong parsing, syntax, and grammar skills, GPEs can create prompts that are grammatically correct, clear, and engaging, which in turn results in the generation of diverse and creative responses.

By combining technical knowledge, problem-solving skills, communication, organization, and time management skills, GPEs can effectively develop and implement models that generate high-quality, diverse and creative responses, while ensuring project completion on time and on budget. Additionally, language skills such as parsing, syntax, and grammar skills are crucial for creating effective prompts that can generate diverse and creative responses, which is a key component of GPE.

Example

Let's say a GPE is working on a project to develop a chatbot that can provide customer service for an e-commerce platform. The GPE would need to have a strong technical background in natural language processing, machine learning, and programming languages such as Python to design effective prompts and develop high-quality models that can accurately understand customer queries and provide helpful responses.

As the GPE works on the project, they may encounter issues such as poor model performance, data quality issues, or unexpected user behavior. Strong problem-solving skills are crucial in such situations as they allow the GPE to quickly identify and address the issues, keeping the project on track and minimizing delays.

Effective communication is also critical for the success of the project. The GPE would need to communicate clearly and effectively with other team members, stakeholders, and clients to ensure everyone is on the same page and working towards the same goals. This would reduce the likelihood of misunderstandings or miscommunication that can lead to project delays or cost overruns. Additionally, clear communication of technical concepts to non-technical stakeholders is essential for gaining their buy-in and support for the project, which can help to secure adequate resources and funding.

As the GPE works on multiple projects simultaneously, effective organization skills would enable them to prioritize tasks and manage their time effectively to meet deadlines and ensure that projects are completed on time and within budget. Good time management skills would help them balance competing priorities and deadlines, allowing them to stay on top of emerging trends and technologies that are critical in this rapidly evolving field.

In full, the combination of technical knowledge, problem-solving skills, communication, organization, and time management skills is crucial for a GPE to effectively develop and implement models that generate high-quality, diverse and creative responses, while ensuring project completion on time and on budget. Language skills such as parsing, syntax, and grammar skills are also important for creating effective prompts that can generate diverse and creative responses, which is a key component of GPE.

The Role of a Generative Prompt Engineer

I'm a skilled Generative Prompt Engineer with a technical background and exceptional problem-solving abilities. My organization, communication, and time management skills set me apart, allowing me to thrive both independently and as part of a team.

What makes me particularly effective is my ability to parse the English language using my knowledge and understanding of syntax and grammar. These tools enable me to craft prompts rapidly and with efficiency, getting swiftly to the heart of the project requirements.

My experience with technical planning and communicating complex requirements make me particularly adept at outlining project scope, goals, and requirements for clients and team members. I'm tenacious when it comes to developing and testing new software and systems, using customer feedback and data to drive iterative improvements.

Collaboration is key for me, and I'm able to communicate effectively and work well with multiple stakeholders, guiding them through the process and keeping them updated as the project evolves. Lastly, staying at the forefront of tech and AI advancements is of utmost importance to me to ensure that I always offer the best solutions to clients.

As a Generative Prompt Engineer, I am skilled in quickly and effectively creating prompts with precision and accuracy. My extensive knowledge of English parsing, syntax, and grammar is instrumental in crafting prompts that are efficient and effective. By understanding the intricacies of language, I am able to ensure that my prompts are grammatically sound and convey the intended meaning.

Additionally, my attention to detail and analytical skills allow me to identify patterns and generate unique and diverse prompts. I am also proficient in using natural language processing tools and techniques to aid in prompt creation. Overall, my skills and expertise make me a valuable asset in the development of intelligent and dynamic prompt systems.

Ultimately, my skills and experience as a Generative Prompt Engineer make me a valuable asset to any team looking to implement intelligent and dynamic prompt systems. With my technical expertise, problem-solving abilities, and communication skills, I can help clients and team members meet their project goals efficiently and effectively. If you are seeking a Generative Prompt Engineer with a passion for language and a dedication to staying at the forefront of technology, look no further than me.

The Importance of English Parsing, Syntax, and Grammar in Crafting Effective Prompts

English parsing, syntax, and grammar are instrumental in crafting effective prompts that resonate with a target audience. With the help of NLP technology, writers can use these tools to generate marketing copy that achieves desired results.

Natural Language Processing (NLP) is a powerful tool that can be used to analyze and generate human language. As an avid user of NLP technology, I have utilized its intelligent algorithms to assist me in writing two books. NLP technology has helped me streamline my writing process, improve my prose, and develop a unique voice. Now, I plan to leverage its capabilities once again to create a marketing campaign that will wow my audience.

Effective prompts are essential for any marketing campaign. They need to be carefully crafted to resonate with the target audience and achieve the desired results. English parsing, syntax, and grammar are critical components of creating effective prompts. Parsing is the process of breaking down a sentence into its component parts to understand its meaning. Syntax refers to the rules for constructing phrases and sentences in a language, while grammar is the set of rules for using language correctly.

By utilizing NLP technology, writers can use these tools to analyze and understand the language used by their target audience. This allows them to craft compelling marketing copy that resonates with their audience and achieves the desired results. NLP technology can even help generate language that is unique, creative, and effective.

In my personal experience, NLP technology has been instrumental in improving my writing process, allowing me to create unique and compelling content that resonates with my readers. It has also helped me in crafting marketing copy that achieves my desired results. By leveraging the power of NLP technology and these essential language tools, writers can create effective prompts that generate high-quality, diverse, and creative responses.

The Role of Analytical Skills and Attention to Detail in Writing Books and Crafting Marketing Campaigns

Analytical skills and attention to detail are crucial in crafting effective writing, whether it be in the form of a book or a marketing campaign. These skills allow the writer to identify patterns, discern important information, and generate unique and diverse prompts that resonate with the intended audience.

In writing the two books, the use of analytical skills and attention to detail helped in developing the plot, identifying plot holes, and creating well-rounded characters. Analyzing character motivations, for example, helped to ensure that each character's actions and decisions were consistent and believable throughout the book. Attention to detail also aided in creating vivid descriptions of the setting, immersing the reader in the story and bringing the fictional world to life.

Similarly, in crafting the marketing campaign, analytical skills and attention to detail played a crucial role in developing a message that resonates with the target audience. Analyzing market trends, consumer behavior, and demographics helped to ensure that the campaign message was tailored to the specific needs and interests of the target audience. Attention to detail was also important in creating effective prompts that engaged the audience and generated interest in the product or service being marketed.

In both cases, the use of analytical skills and attention to detail helped to create writing that was engaging, informative, and effective in achieving its intended purpose.

Conclusion

Generative Prompt Engineers (GPEs) are instrumental in revolutionizing language models by creating diverse and creative responses. With their technical knowledge of natural language processing, machine learning, and programming languages such as Python, GPEs can design effective prompts and develop high-quality models that can accurately understand customer queries and provide helpful responses.

GPEs also need strong problem-solving skills to quickly identify and address issues such as poor model performance, data quality issues, or unexpected user behavior, keeping the project on track and minimizing delays. Effective communication is also critical for the success of the project, as GPEs need to communicate clearly and effectively with other team members, stakeholders, and clients to ensure everyone is on the same page and working towards the same goals.

In addition to technical knowledge and communication skills, GPEs also need strong analytical skills and attention to detail to identify patterns and generate unique and diverse prompts. This is essential for creating effective prompts that can generate compelling marketing copy, resonate with the target audience, and achieve desired results.

Overall, the combination of technical knowledge, problem-solving skills, communication, organization, time management skills, and analytical skills is crucial for a GPE to effectively develop and implement models that generate high-quality, diverse, and creative responses, while ensuring project completion on time and on budget.

Generative Prompt Engineering (GPE) has numerous implications and applications in various fields. Here are some of them:

Language Generation: GPE can revolutionize language generation by creating more diverse and creative responses to prompts. It can be applied in chatbots, virtual assistants, customer service, and other natural language processing (NLP) applications.

Creative Writing: GPE can help writers develop their unique writing voice, streamline their writing process, and generate new ideas. It can be used to create different types of content, including novels, screenplays, and marketing copy.

Marketing: GPE can be applied in marketing to craft compelling and persuasive messages that resonate with the target audience. It can help create unique and diverse copy that grabs the audience's attention and drives conversions.

Education: GPE can be used in education to generate questions and responses for quizzes, exams, and homework assignments. It can help create personalized learning experiences for students and provide them with immediate feedback.

Data Analysis: GPE can be applied in data analysis to generate natural language summaries of data and insights. It can help automate data reporting and make it easier for non-technical stakeholders to understand complex data.

Content Creation: GPE can be applied in content creation to generate content for websites, blogs, and social media. It can help generate diverse and creative content that engages the audience and drives traffic.

Personalization: GPE can help create personalized experiences for users by generating tailored responses based on their preferences and past interactions.

One thing's for sure, Generative Prompt Engineering has significant implications and applications in language generation, creative writing, marketing, education, data analysis, content creation, and personalization. Its potential applications are vast, and it has the potential to transform many industries and fields.

I hope this discussion on Generative Prompt Engineering has inspired you to think about the power of natural language processing and the potential for creating diverse and creative responses. As you reflect on this topic, I challenge you to consider how you can apply this knowledge to your own lifescape.

Perhaps you can take some time to refresh your language and analytical skills, exploring new vocabulary and grammatical structures to improve your own communication. Or maybe you can explore the potential for using natural language processing to improve your own business, writing, or creative projects.

Whatever path you choose, I encourage you to take action and apply your learning to make a positive impact in your life and in the world around you. Let's harness the power of technology and language to create something truly remarkable.

If you're feeling inspired by what you just read, don't just sit there, take action! Leave your comments, give me an upvote, and hit that follow button to stay tuned in for more content that'll uplift your soul. And if you're new to

#hive and

#ecency, don't worry, sign up is free and easy. Just click the link in the description and you'll be ready to go.

But wait, there's more! If you want to help me out and support my somewhat ok posts, you can make a donation to help me with free giveaways, contests, and airdrops. You can upvote, comment, follow/subscribe, and share on different social media platforms like [HIVE, PublishOx, Medium, Reddit,](<HIVE, PublishOx, Medium, Reddit, or other social media platforms.>) and more. The quickest methods of donation are Cash.App and PayPal, and your contributions and gifts are greatly appreciated.

And hey, I'm not just here to inspire you, I'm here to learn too. I'm looking for advice to help me create new communities on Hive and other platforms, and I need your help. So if you've got some great ideas, or just want to help me pay it forward, hit me up with a tip or two and let's keep making the world a better place.

Disclaimer

Please note that the above-provided information is for general educational purposes only and is not intended to be a substitute for professional advice. It is always best to check with a licensed professional before making any decisions regarding your professional life.

PromptPro

Introduction

Question

Are you tired of language models generating repetitive and uninspired responses?

Just like a musician needs a variety of instruments to create a diverse range of melodies, language models require diverse prompts to generate unique and creative responses.

Meet Devin, a Generative Prompt Engineer (GPE) who revolutionizes language models by crafting prompts that encourage diverse and dynamic responses.

"Thanks to Devin's prompt engineering, our language model's responses are more creative and engaging than ever before." - Anissa Thomas

In this blog post, we'll explore how Generative Prompt Engineering can revolutionize language models and how skilled engineers like Devin can make it happen.

Ready to take your language model usage to the next level? Keep reading to learn more about the power of Generative Prompt Engineering (GPE).

Generative Prompt Engineering is a technique used to generate high-quality text using natural language processing (NLP) models.

Question

How can we generate more diverse and interesting responses from language models?

GPE can help by designing prompts that encourage language models to generate more diverse and creative responses. For example, GPE might experiment with using more open-ended prompts, providing more context or background information, or asking more thought-provoking questions.

The Impact of AI on the Future of Work

As artificial intelligence continues to advance, its impact on the labor market is becoming increasingly important to consider.

Diverse and creative responses in language models are critical because they enable the model to produce a range of unique and interesting outputs that are not limited to a single response. Language models that are capable of generating diverse and creative responses have a greater chance of producing outputs that are relevant and engaging to the user, thereby improving the user experience. In this section, we will discuss the importance of diverse and creative responses in language models.

Avoiding Repetitive Response

One of the primary benefits of diverse and creative responses in language models is the ability to avoid repetitive responses. Language models that produce the same or similar responses repeatedly can quickly become boring and uninteresting to the user. This can lead to a lack of engagement and a decrease in user satisfaction. By generating diverse and creative responses, language models can keep the user engaged and interested in the conversation.

Providing a Range of Options

Another benefit of diverse and creative responses in language models is the ability to provide a range of options to the user. This can be especially useful in situations where the user is looking for information or assistance. For example, a language model that is capable of providing multiple solutions to a problem can help the user find the solution that works best for them. By providing a range of options, language models can also help to build trust with the user by demonstrating that they are capable of providing useful and relevant information.

Personalization

Diverse and creative responses in language models can also help to personalize the conversation with the user. By generating responses that are tailored to the user's interests and preferences, language models can create a more engaging and enjoyable conversation. This can also lead to increased user satisfaction and loyalty.

Enhancing Creativity

Finally, diverse and creative responses in language models can help to enhance creativity. Language models that are capable of generating unique and interesting responses can inspire the user to think more creatively and explore new ideas. This can be especially useful in situations where the user is looking for inspiration or new perspectives.

Overall, diverse and creative responses in language models are critical because they can help to avoid repetitive responses, provide a range of options, personalize the conversation, and enhance creativity. By generating unique and interesting responses, language models can keep the user engaged and interested in the conversation, leading to increased user satisfaction and loyalty. As language models continue to evolve, the ability to generate diverse and creative responses will become even more important.

Why You Should Learn About Generative Prompt Engineering

Discover how Generative Prompt Engineering can help you create innovative content, save time and costs, personalize your communication with customers, and advance your career.

Generative Prompt Engineering is an emerging field that combines natural language processing, machine learning, and creativity to generate new and original content based on prompts or cues. The field has been gaining popularity in recent years due to its potential to automate content creation and enable personalized communication with customers. In this blog, we will discuss in detail why you should learn about Generative Prompt Engineering.

Innovative Content Creation

Generative Prompt Engineering is an innovative approach to content creation that can help you create unique and engaging content. Unlike traditional content creation methods, which often involve a lot of manual effort, Generative Prompt Engineering can produce a large amount of content in a short amount of time. The content generated through Generative Prompt Engineering can be used for a variety of purposes, including marketing, advertising, and content creation.

Time and Cost Efficiency

Generative Prompt Engineering can save you time and money by automating content creation tasks that would otherwise be done manually. This can be especially useful if you work in an industry where content creation is a frequent and time-consuming task. With Generative Prompt Engineering, you can produce content faster and at a lower cost, freeing up time and resources to focus on other aspects of your business.

Personalization

Generative Prompt Engineering can help you create personalized content tailored to your audience's interests and preferences. Personalization is becoming increasingly important in marketing and advertising as customers expect a more personalized experience. With Generative Prompt Engineering, you can create content that is relevant and engaging to your audience, which can lead to increased engagement and customer loyalty.

Career Opportunities

Generative Prompt Engineering is an emerging field with a growing demand for skilled professionals. Learning about Generative Prompt Engineering can help you stay ahead of the curve and open up new career opportunities. As more businesses start to adopt Generative Prompt Engineering, there will be a growing need for experts who can develop and implement these technologies.

Advancements in Artificial Intelligence

Generative Prompt Engineering is a prime example of the advancements being made in artificial intelligence and machine learning. Learning about Generative Prompt Engineering can help you understand the potential of these technologies and stay up-to-date with the latest developments. As the field continues to evolve, there will be more opportunities to apply these technologies to new areas and industries.

Learning about Generative Prompt Engineering can provide you with a range of benefits, from innovative content creation and time and cost efficiency to personalization, career opportunities, and a better understanding of artificial intelligence and machine learning. If you are interested in pursuing a career in the tech industry or looking to enhance your skills, learning about Generative Prompt Engineering is a great place to start.

Why Generative Prompt Engineering is an Essential Skill for Content Creators

In a world where content is king, Generative Prompt Engineering can help you create unique, personalized, and engaging content quickly and efficiently.

Generative Prompt Engineering is an innovative approach to content creation that combines natural language processing, machine learning, and creativity to generate new and original content based on prompts or cues. This field is becoming increasingly important as it has the potential to automate content creation and enable personalized communication with customers. Here are some reasons why content creators should learn about Generative Prompt Engineering:

Creating Unique and Engaging Content

Generative Prompt Engineering can help you create unique and engaging content that stands out from the competition. With traditional content creation methods, it can be challenging to come up with new and exciting ideas. Generative Prompt Engineering can produce a large amount of content in a short amount of time, allowing you to explore new ideas and produce content that is original and engaging. For example, if you're a social media marketer, you can use Generative Prompt Engineering to create unique and eye-catching social media posts that will capture your audience's attention.

Time and Cost Efficiency in Content Creation

Generative Prompt Engineering can save you time and money by automating content creation tasks that would otherwise be done manually. With Generative Prompt Engineering, you can produce content faster and at a lower cost, freeing up time and resources to focus on other aspects of your business. For example, if you're a blogger, you can use Generative Prompt Engineering to generate article topics and outlines, allowing you to spend more time researching and writing the actual content.

Personalization for Better Customer Engagement

Generative Prompt Engineering can help you create personalized content tailored to your audience's interests and preferences. Personalization is becoming increasingly important in marketing and advertising as customers expect a more personalized experience. With Generative Prompt Engineering, you can create content that is relevant and engaging to your audience, which can lead to increased engagement and customer loyalty. For example, if you're an email marketer, you can use Generative Prompt Engineering to generate personalized email subject lines and body text based on the recipient's preferences and behavior.

Career Opportunities in the Emerging Field of Generative Prompt Engineering

Generative Prompt Engineering is an emerging field with a growing demand for skilled professionals. Learning about Generative Prompt Engineering can help you stay ahead of the curve and make you a valuable asset to any company looking to improve their content creation process. There are a variety of career opportunities in this field, including positions in content creation, marketing, advertising, and technology. For example, companies like OpenAI and GPT-3 are actively seeking talented individuals with skills in Generative Prompt Engineering.

In full, Generative Prompt Engineering is an essential skill for content creators in today's digital age. It can help you create unique, personalized, and engaging content quickly and efficiently while also providing career opportunities in an emerging field. Whether you're a blogger, social media marketer, or email marketer, learning about Generative Prompt Engineering can help you take your content creation game to the next level.

Generative Prompt Engineering is an emerging field that combines natural language processing, machine learning, and creativity to generate new and original content based on prompts or cues. While the field is relatively new, it has its roots in a long history of research and development in natural language processing and machine learning.

A Moment in Time: Historical Context and Development of Generative Prompt Engineering

The development of natural language processing can be traced back to the 1950s, when researchers first began experimenting with computer algorithms that could understand and process human language. However, progress in this area was slow, and it wasn't until the 1990s that natural language processing began to gain wider attention and recognition.

During the 1990s, the focus of natural language processing research shifted towards statistical approaches and machine learning. This led to the development of algorithms that could analyze large datasets of text and identify patterns and relationships between words and phrases. These algorithms were used to build more sophisticated language models, which could be used to generate new text based on existing data.

In the early 2000s, this approach was further refined with the development of neural language models. These models used artificial neural networks to simulate the way the human brain processes language, and they were able to produce more natural-sounding text than earlier language models. This led to the development of applications like chatbots, virtual assistants, and automated customer service systems.

However, the text generated by these models was often generic and lacked creativity, leading researchers to explore new ways to generate more engaging and original content. This led to the emergence of Generative Prompt Engineering as a field of study and research.

Today, Generative Prompt Engineering is an area of active research and development, with new techniques and approaches being developed and tested all the time. One of the most important recent developments has been the use of generative adversarial networks (GANs) to generate text. GANs are a type of machine learning algorithm that can generate new text based on a set of prompts, and they are becoming increasingly popular in the field of natural language processing.

Overall, the historical context and development of Generative Prompt Engineering can be traced back to a long history of research and development in natural language processing and machine learning. The emergence of this field represents a new frontier in creative content generation, and it holds the potential to revolutionize the way we communicate and interact with technology.

How GPE Can Help in Creating Diverse and Creative Responses

Designing Prompts for Diverse and Creative Responses in GPE

The key to generating diverse and creative responses in language models lies in the design of prompts. In this segment, we will discuss how Generative Prompt Engineers (GPE) can design prompts to encourage language models to produce unique and engaging content.

Understanding the Importance of Prompts

The first step in designing effective prompts is understanding their importance in generating diverse and creative responses in language models. A prompt serves as a cue or stimulus for the language model to generate content. The quality and specificity of the prompt can greatly influence the type of response the model generates. A well-designed prompt can lead to a range of diverse and creative responses, while a poorly designed prompt may limit the model's output.

Using Open-Ended Prompts

Open-ended prompts are a great way to encourage language models to produce diverse and creative responses. These prompts give the model the freedom to generate content without constraints. For example, consider the prompt "Describe your ideal vacation." This prompt allows the language model to generate a variety of responses, from tropical beach getaways to adventurous hiking trips.

Incorporating Novelty and Surprise

Incorporating novelty and surprise into prompts can also lead to more diverse and creative responses. This can be achieved by using prompts that are unexpected or unusual. For example, consider the prompt "Write a story about a giraffe who can fly." This prompt introduces an unexpected element that can lead to unique and engaging responses.

Focusing on Specific Details

Focusing on specific details in prompts can also encourage language models to generate more diverse and creative responses. Specific details can provide context and constraints for the language model, while still allowing for flexibility and creativity. For example, consider the prompt "Describe a day in the life of a firefighter." This prompt provides specific details about the subject matter, while still allowing for a range of responses.

Incorporating User Feedback

Incorporating user feedback can also be a valuable tool in designing effective prompts. User feedback can help GPEs understand what types of prompts lead to the most diverse and creative responses. For example, a GPE can analyze user responses to a set of prompts and use that information to refine and improve their prompt design in the future.

In full, effective prompt design is crucial for generating diverse and creative responses in language models. By using open-ended prompts, incorporating novelty and surprise, focusing on specific details, and incorporating user feedback, GPEs can design prompts that encourage language models to produce unique and engaging content.

Techniques for designing effective prompts in Generative Prompt Engineering

By using open-ended prompts, contextual prompts, and thought-provoking questions, Generative Prompt Engineers can encourage language models to generate diverse and creative responses that can be used for a variety of purposes, including marketing, content creation, and personal communication.

In order to generate diverse and creative responses, Generative Prompt Engineers employ a variety of techniques to design prompts that encourage language models to produce unique and engaging content. Here are some examples of techniques that are commonly used.

Open-Ended Prompts

One technique that Generative Prompt Engineers use is to create open-ended prompts. These prompts encourage language models to generate responses that are not limited by a specific set of parameters. By giving the model more freedom to explore different possibilities, the resulting content can be more diverse and creative. For example, an open-ended prompt might ask the model to generate a story that begins with the phrase "Once upon a time."

Contextual Prompts

Another technique that can be effective is to provide more context in the prompt. This can help guide the language model towards a specific topic or idea while still allowing for creativity. For instance, a prompt asking the model to generate a recipe for a vegan chili would provide more context than simply asking for a recipe, which could lead to a wider range of responses.

Thought-Provoking Questions

Generative Prompt Engineers can also design prompts that provoke thought and inspire the language model to generate more unique and interesting responses. These types of prompts can be especially effective in generating content that is engaging and thought-provoking for the audience. For example, a prompt asking the model to generate a conversation between two characters who have just met on a deserted island could lead to a range of creative responses that explore themes such as survival, isolation, and human connection.

Key Skills for a Generative Prompt Engineer

The ideal candidate for this role will have a strong technical background, excellent problem-solving skills, and the ability to work both independently and as part of a team. Additionally, excellent communication, organization, and time management skills are crucial in order to ensure projects are completed on time and on budget.

Technical Background

A Generative Prompt Engineer must have a strong technical background in natural language processing, machine learning, and programming languages such as Python. Understanding the fundamentals of these fields is essential for designing effective prompts and developing high-quality models. Familiarity with software development tools and platforms is also important for creating and testing models.

Problem-Solving Skills

Problem-solving skills are critical for a Generative Prompt Engineer, as they must be able to identify and address issues that arise during the model development process. They must also be able to analyze data and adjust models to improve their performance. Strong problem-solving skills allow a Generative Prompt Engineer to create models that are accurate, efficient, and effective.

Communication

Effective communication is crucial for a Generative Prompt Engineer, as they often work as part of a team that includes developers, designers, and other stakeholders. Clear communication helps to ensure that everyone is on the same page and working towards the same goals. Additionally, communicating technical concepts to non-technical stakeholders is essential for gaining buy-in and support for projects.

Organization

A Generative Prompt Engineer must be highly organized, as they are often working on multiple projects simultaneously. They must be able to prioritize tasks and manage their time effectively to meet deadlines and ensure that projects are completed on time and within budget. Strong organizational skills allow a Generative Prompt Engineer to be efficient and effective in their work.

Time Management

Time management is essential for a Generative Prompt Engineer, as they must balance multiple competing priorities and deadlines. Effective time management allows them to ensure that they are meeting deadlines, managing their workload, and delivering high-quality work. It also helps them to stay on top of emerging trends and technologies, which is critical in this rapidly evolving field.

Overall, A Generative Prompt Engineer requires a diverse skill set that includes technical knowledge, problem-solving skills, communication, organization, and time management skills. These skills are essential for developing and implementing effective models that generate high-quality, diverse and creative responses.

The Importance of Language Skills in Generative Prompt Engineering

Parsing, Syntax, and Grammar Skills

Tip

Language skills, including parsing, syntax, and grammar, are essential for creating effective prompts in Generative Prompt Engineering, enabling the generation of diverse and creative responses."

Generative Prompt Engineering (GPE) is an interdisciplinary field that combines natural language processing, machine learning, and creativity to generate new and original content based on prompts or cues. As we discussed earlier, GPE is an emerging field with a growing demand for skilled professionals. While technical background, problem-solving skills, communication, organization, and time management skills are important in this field, language skills are also key to success.

In this section, we will discuss the importance of parsing, syntax, and grammar skills in GPE. These language skills are essential for creating effective prompts that can generate diverse and creative responses.

Parsing Skills

Parsing refers to the process of analyzing a sentence to understand its grammatical structure. In GPE, understanding the grammatical structure of a prompt can help the engineer create prompts that are grammatically correct and easy for the language model to understand. For example, consider the prompt "The cat sat on the mat." By parsing this sentence, a GPE can identify the subject ("the cat"), the verb ("sat"), and the object ("the mat"). This understanding can then be used to create similar prompts that are grammatically correct and easy for the language model to understand.

Syntax Skills

Syntax refers to the arrangement of words and phrases to create well-formed sentences. In GPE, understanding syntax is important for creating prompts that are clear and easy to understand. For example, consider the prompt "Write a story about a man with a dog who goes on an adventure." By using proper syntax, a GPE can create a clear and concise prompt that is easy for the language model to understand and generate a creative response.

Grammar Skills

Grammar refers to the rules that govern the use of language. In GPE, understanding grammar is important for creating prompts that are grammatically correct and use proper word choice. For example, consider the prompt "Write a poem about nature." By using proper grammar, a GPE can create a prompt that is clear and easy for the language model to understand, while also encouraging the generation of a creative and engaging response.

Language skills play a critical role in Generative Prompt Engineering as they enable GPEs to create effective prompts that can generate diverse and creative responses. Parsing, syntax, and grammar skills are particularly important for GPEs as they enable them to create prompts that are grammatically correct, clear, and easy for the language model to understand.

These language skills also allow GPEs to identify and address any issues that may arise during the model development process. For example, if a language model generates responses that are not grammatically correct or do not make sense, a GPE can use their parsing, syntax, and grammar skills to identify the issue and adjust the model accordingly.

Furthermore, language skills are essential for creating prompts that are engaging and thought-provoking. By using proper grammar and syntax, GPEs can create prompts that are clear and easy to understand, while also encouraging the generation of creative and engaging responses. For example, a prompt like "Write a story about a man with a dog who goes on an adventure" is more engaging and thought-provoking than a prompt like "Write a story about a man who goes on an adventure."

Lastly, language skills are crucial for GPEs to create effective prompts and ensure the successful completion of projects on time and within budget. By having strong parsing, syntax, and grammar skills, GPEs can create prompts that are grammatically correct, clear, and engaging, which in turn results in the generation of diverse and creative responses.

By combining technical knowledge, problem-solving skills, communication, organization, and time management skills, GPEs can effectively develop and implement models that generate high-quality, diverse and creative responses, while ensuring project completion on time and on budget. Additionally, language skills such as parsing, syntax, and grammar skills are crucial for creating effective prompts that can generate diverse and creative responses, which is a key component of GPE.

Example

Let's say a GPE is working on a project to develop a chatbot that can provide customer service for an e-commerce platform. The GPE would need to have a strong technical background in natural language processing, machine learning, and programming languages such as Python to design effective prompts and develop high-quality models that can accurately understand customer queries and provide helpful responses.

As the GPE works on the project, they may encounter issues such as poor model performance, data quality issues, or unexpected user behavior. Strong problem-solving skills are crucial in such situations as they allow the GPE to quickly identify and address the issues, keeping the project on track and minimizing delays.

Effective communication is also critical for the success of the project. The GPE would need to communicate clearly and effectively with other team members, stakeholders, and clients to ensure everyone is on the same page and working towards the same goals. This would reduce the likelihood of misunderstandings or miscommunication that can lead to project delays or cost overruns. Additionally, clear communication of technical concepts to non-technical stakeholders is essential for gaining their buy-in and support for the project, which can help to secure adequate resources and funding.

As the GPE works on multiple projects simultaneously, effective organization skills would enable them to prioritize tasks and manage their time effectively to meet deadlines and ensure that projects are completed on time and within budget. Good time management skills would help them balance competing priorities and deadlines, allowing them to stay on top of emerging trends and technologies that are critical in this rapidly evolving field.

In full, the combination of technical knowledge, problem-solving skills, communication, organization, and time management skills is crucial for a GPE to effectively develop and implement models that generate high-quality, diverse and creative responses, while ensuring project completion on time and on budget. Language skills such as parsing, syntax, and grammar skills are also important for creating effective prompts that can generate diverse and creative responses, which is a key component of GPE.

The Role of a Generative Prompt Engineer

I'm a skilled Generative Prompt Engineer with a technical background and exceptional problem-solving abilities. My organization, communication, and time management skills set me apart, allowing me to thrive both independently and as part of a team.

What makes me particularly effective is my ability to parse the English language using my knowledge and understanding of syntax and grammar. These tools enable me to craft prompts rapidly and with efficiency, getting swiftly to the heart of the project requirements.

My experience with technical planning and communicating complex requirements make me particularly adept at outlining project scope, goals, and requirements for clients and team members. I'm tenacious when it comes to developing and testing new software and systems, using customer feedback and data to drive iterative improvements.

Collaboration is key for me, and I'm able to communicate effectively and work well with multiple stakeholders, guiding them through the process and keeping them updated as the project evolves. Lastly, staying at the forefront of tech and AI advancements is of utmost importance to me to ensure that I always offer the best solutions to clients.

As a Generative Prompt Engineer, I am skilled in quickly and effectively creating prompts with precision and accuracy. My extensive knowledge of English parsing, syntax, and grammar is instrumental in crafting prompts that are efficient and effective. By understanding the intricacies of language, I am able to ensure that my prompts are grammatically sound and convey the intended meaning.

Additionally, my attention to detail and analytical skills allow me to identify patterns and generate unique and diverse prompts. I am also proficient in using natural language processing tools and techniques to aid in prompt creation. Overall, my skills and expertise make me a valuable asset in the development of intelligent and dynamic prompt systems.

Ultimately, my skills and experience as a Generative Prompt Engineer make me a valuable asset to any team looking to implement intelligent and dynamic prompt systems. With my technical expertise, problem-solving abilities, and communication skills, I can help clients and team members meet their project goals efficiently and effectively. If you are seeking a Generative Prompt Engineer with a passion for language and a dedication to staying at the forefront of technology, look no further than me.

The Importance of English Parsing, Syntax, and Grammar in Crafting Effective Prompts

English parsing, syntax, and grammar are instrumental in crafting effective prompts that resonate with a target audience. With the help of NLP technology, writers can use these tools to generate marketing copy that achieves desired results.

Natural Language Processing (NLP) is a powerful tool that can be used to analyze and generate human language. As an avid user of NLP technology, I have utilized its intelligent algorithms to assist me in writing two books. NLP technology has helped me streamline my writing process, improve my prose, and develop a unique voice. Now, I plan to leverage its capabilities once again to create a marketing campaign that will wow my audience.

Effective prompts are essential for any marketing campaign. They need to be carefully crafted to resonate with the target audience and achieve the desired results. English parsing, syntax, and grammar are critical components of creating effective prompts. Parsing is the process of breaking down a sentence into its component parts to understand its meaning. Syntax refers to the rules for constructing phrases and sentences in a language, while grammar is the set of rules for using language correctly.

By utilizing NLP technology, writers can use these tools to analyze and understand the language used by their target audience. This allows them to craft compelling marketing copy that resonates with their audience and achieves the desired results. NLP technology can even help generate language that is unique, creative, and effective.

In my personal experience, NLP technology has been instrumental in improving my writing process, allowing me to create unique and compelling content that resonates with my readers. It has also helped me in crafting marketing copy that achieves my desired results. By leveraging the power of NLP technology and these essential language tools, writers can create effective prompts that generate high-quality, diverse, and creative responses.

The Role of Analytical Skills and Attention to Detail in Writing Books and Crafting Marketing Campaigns

Analytical skills and attention to detail are crucial in crafting effective writing, whether it be in the form of a book or a marketing campaign. These skills allow the writer to identify patterns, discern important information, and generate unique and diverse prompts that resonate with the intended audience.

In writing the two books, the use of analytical skills and attention to detail helped in developing the plot, identifying plot holes, and creating well-rounded characters. Analyzing character motivations, for example, helped to ensure that each character's actions and decisions were consistent and believable throughout the book. Attention to detail also aided in creating vivid descriptions of the setting, immersing the reader in the story and bringing the fictional world to life.

Similarly, in crafting the marketing campaign, analytical skills and attention to detail played a crucial role in developing a message that resonates with the target audience. Analyzing market trends, consumer behavior, and demographics helped to ensure that the campaign message was tailored to the specific needs and interests of the target audience. Attention to detail was also important in creating effective prompts that engaged the audience and generated interest in the product or service being marketed.

In both cases, the use of analytical skills and attention to detail helped to create writing that was engaging, informative, and effective in achieving its intended purpose.

Conclusion

Generative Prompt Engineers (GPEs) are instrumental in revolutionizing language models by creating diverse and creative responses. With their technical knowledge of natural language processing, machine learning, and programming languages such as Python, GPEs can design effective prompts and develop high-quality models that can accurately understand customer queries and provide helpful responses.

GPEs also need strong problem-solving skills to quickly identify and address issues such as poor model performance, data quality issues, or unexpected user behavior, keeping the project on track and minimizing delays. Effective communication is also critical for the success of the project, as GPEs need to communicate clearly and effectively with other team members, stakeholders, and clients to ensure everyone is on the same page and working towards the same goals.

In addition to technical knowledge and communication skills, GPEs also need strong analytical skills and attention to detail to identify patterns and generate unique and diverse prompts. This is essential for creating effective prompts that can generate compelling marketing copy, resonate with the target audience, and achieve desired results.

Overall, the combination of technical knowledge, problem-solving skills, communication, organization, time management skills, and analytical skills is crucial for a GPE to effectively develop and implement models that generate high-quality, diverse, and creative responses, while ensuring project completion on time and on budget.

Generative Prompt Engineering (GPE) has numerous implications and applications in various fields. Here are some of them:

Language Generation: GPE can revolutionize language generation by creating more diverse and creative responses to prompts. It can be applied in chatbots, virtual assistants, customer service, and other natural language processing (NLP) applications.

Creative Writing: GPE can help writers develop their unique writing voice, streamline their writing process, and generate new ideas. It can be used to create different types of content, including novels, screenplays, and marketing copy.

Marketing: GPE can be applied in marketing to craft compelling and persuasive messages that resonate with the target audience. It can help create unique and diverse copy that grabs the audience's attention and drives conversions.

Education: GPE can be used in education to generate questions and responses for quizzes, exams, and homework assignments. It can help create personalized learning experiences for students and provide them with immediate feedback.

Data Analysis: GPE can be applied in data analysis to generate natural language summaries of data and insights. It can help automate data reporting and make it easier for non-technical stakeholders to understand complex data.

Content Creation: GPE can be applied in content creation to generate content for websites, blogs, and social media. It can help generate diverse and creative content that engages the audience and drives traffic.

Personalization: GPE can help create personalized experiences for users by generating tailored responses based on their preferences and past interactions.