THAT I MAY KNOW HIM![PHP.3:10]

MERE CRITICISM CAN'T ROOT OUT THE DECAY FROM THE CHURCH TODAY!

I was reading a message written about 17 years ago,and I came across something that made me wonder if it's true!

Could it be that when one generation allows God’s house to become empty the next generation pays the price? Could it be that we are in danger of losing our children to the world because we have neglected to show them the power of God at work in and through the Church? These are heavy questions. And I don’t mean to come on too strong this evening, but let us take a good solid look at ourselves.

The thing is most of us are now into the third generation as Christians. Most of us, my age, can remember our great-grandparents, our grandparents, and our parents. If you are saved and in the church now, it is probably because you had some strong Christian roots that were handed down from your great-grandparents to your grand-parents, to your parents. In other words, you have a background of folk who knew the Lord as their Saviour

They were people of sacrifice and prayer. They cherished the Touch of God. Many of them blazed the trails. They laid the groundwork for the revival... the fire that consumed both the old and the young of that generation.

In that sense,we of today, should be weeping, for we owe a great debt to those old soldiers, but the question for us is: “What’s happened to the fire and the sacrifice, and the prayer in us? What will we be leaving for the generation of young men and young women who are coming after us, who are watching what we do and how we act, and what we say, and how we treat one another, and that is if CHRIST JESUS TARRIES?

Today, we have so allowed the enemy to frustrate the church and individual families that altars that were sacred have been abandoned. Pastors have gone haywire as God's Work became a financial investment. A money making venture. It NEVER was like this, with the likes of the late archbishop Idahosa that championed prosperity teachings. HOLINESS WAS AND SHOULD STILL BE AN UNCOMPROMISED VIRTUE. Holiness shouldn't be relegated to the background because of prosperity. God NEVER said anywhere in His Word that we would be beggars,as long as we maintain our absolute loyalty to Him. And that *loyalty* means obedience.

Observing our evangelical Zion, I note that we are infected with a debilitating virus that was once confined to those living in the world. Our humour reflects what we watch on television. Consequently, we are growing increasingly coarse and sarcastic in responding to those about us. We defend ourselves in such a way that it appears that we no longer recognise the enemy. We seem to believe that anyone who does not agree with us deserves our scorn, or even our rage. James addresses the tendency of Christians to bring into the new life attitudes which should have been left in the world. We will do well to review his words and learn how to root out rot in our lives;

19. Wherefore, my beloved brethren, let every man be swift to hear, slow to speak, slow to wrath:

20. For the wrath of man worketh not the righteousness of God.

21. Wherefore lay apart all filthiness and superfluity of naughtiness, and receive with meekness the engrafted word, which is able to save your souls. (Jas 1: 19-21)

Holiness is a concept that is seemingly absent from contemporary religious life. The holiness that is accepted among the saints(including pastors)appears artificial...a pale, insipid imitation of the real thing.

Our piety is outward; we substitute religious observance for true holiness. The great tragedy of contemporary evangelicals is that we have what has been described as peg-leg religion...we have to strap it on every morning. And we do know that the devil is behind all this and making good use of the opportunity too.

Please allow me to point out some of the observations I make concerning the absence of holiness.

There was a day(a time)when modesty in dress and demeanour was a mark of a young woman’s or a young man’s Christian walk. I know that our grandmothers were somewhat fanatical about their dress, but somehow young women today, to say nothing of many older women, are indistinguishable from the world in their dress sense,(just to belong)!

Perhaps we have forgotten the apostolic admonition that declares, “I desire then that in every place the men should pray, lifting holy hands without anger or quarrelling; likewise also that women should adorn themselves in respectable apparel, with modesty and self-control, not with braided hair and gold or pearls or costly attire, but with what is proper for women who profess godliness—with good works” [1 Timothy 2:8-10]. The Apostle specifically addresses women’s dress, as that is an apparent problem.

But today,right from kindergarten, parents now dress their children in skimpy worldly attire,all in the name of modernism. When these kids grow up like this, what do we expect from them? And I am talking specifically about supposedly Christian parents...whom should be role models.

It doesn't end with dress sense and expression.Neither of these observations immediately addresses the lack of gentleness, the absence of civility, or the apparent delight in harbouring hostility that now appears to mark the lives of many of the professed saints of God. We have seen them fight themselves on the electronic,print and even more on social media. Each with their own group of supporters prepared for any kind of showdown. These supporters/followers worship their pastors and not God. The word of their pastors is usually the truth. God help you if you speak evil of their *daddy* in their presence.

In part, this condition exists and is tolerated, perhaps even fostered, because churches are run like business and congregants generally have a consumer mentality concerning church. Church leaders are too often selected, not on the basis of godliness, but because of their stature in the community, because of their business acumen, according to the size of their portfolio, or by other such criteria that are valued in the world. Congregants are loath to commit themselves to a congregation, and churches are reluctant to hold members accountable to the standards clearly set forth in the Word of God. Attendance at a service is more highly prized than is commitment and submission to the Body of Christ. As result of substituting our own values for godly values, we seldom witness church bodies that are regenerate. What we do witness are churches that are run like business with application of the latest psychological techniques to continue to “grow” the church.

Pastors are chosen to be administrators instead of being shepherds charged with the ministry of the Word, protecting the flock, oversight of the church, pastoring the people and providing an example in godliness. Consequently, congregations are often ignorant of the Word and of the will of God, and they are frequently unruly in their deportment and conduct. However, Christians usually feel good about themselves, primarily because they are not held accountable for their behaviour and because they see their own behaviour as good as or better than that of the pastor.

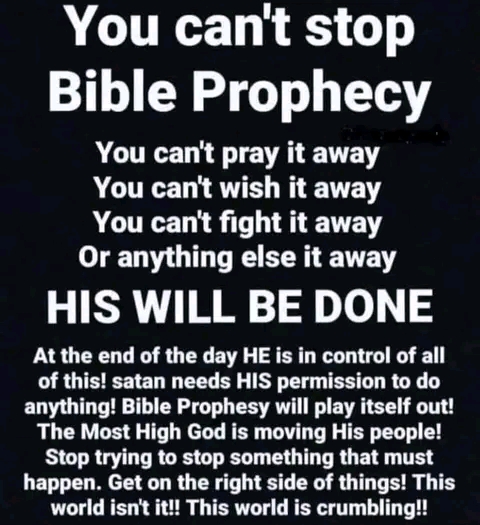

What a tragedy!!! And the devil is gloating over the disaster...but not for long will he gloat, because IT'S BIBLE PROPHECY PLAYING OUT. The most important thing is to be caught on the right side;

3. For the time will come when they will not endure sound doctrine; but after their own lusts shall they heap to themselves teachers, having itching ears;

4. And they shall turn away their ears from the truth, and shall be turned unto fables. (2Ti 4: 3-4)

But on which side do we wish to be found...the Lord's side or the devil's side?

We still have more on this coming by His Grace and Mercy, Amen !

THAT I MAY KNOW HIM![PHP.3:10]

🚥🚥🚥🚥🚥🚥🚥🚥🚥🚥🚥🚥🚥🚥🚥🚥

MERE CRITICISM CAN'T ROOT OUT THE DECAY FROM THE CHURCH TODAY!

🚥🚥🚥🚥🚥🚥🚥🚥🚥🚥🚥🚥🚥🚥🚥🚥

I was reading a message written about 17 years ago,and I came across something that made me wonder if it's true!

Could it be that when one generation allows God’s house to become empty the next generation pays the price? Could it be that we are in danger of losing our children to the world because we have neglected to show them the power of God at work in and through the Church? These are heavy questions. And I don’t mean to come on too strong this evening, but let us take a good solid look at ourselves.

The thing is most of us are now into the third generation as Christians. Most of us, my age, can remember our great-grandparents, our grandparents, and our parents. If you are saved and in the church now, it is probably because you had some strong Christian roots that were handed down from your great-grandparents to your grand-parents, to your parents. In other words, you have a background of folk who knew the Lord as their Saviour

They were people of sacrifice and prayer. They cherished the Touch of God. Many of them blazed the trails. They laid the groundwork for the revival... the fire that consumed both the old and the young of that generation.

In that sense,we of today, should be weeping, for we owe a great debt to those old soldiers, but the question for us is: “What’s happened to the fire and the sacrifice, and the prayer in us? What will we be leaving for the generation of young men and young women who are coming after us, who are watching what we do and how we act, and what we say, and how we treat one another, and that is if CHRIST JESUS TARRIES?

Today, we have so allowed the enemy to frustrate the church and individual families that altars that were sacred have been abandoned. Pastors have gone haywire as God's Work became a financial investment. A money making venture. It NEVER was like this, with the likes of the late archbishop Idahosa that championed prosperity teachings. HOLINESS WAS AND SHOULD STILL BE AN UNCOMPROMISED VIRTUE. Holiness shouldn't be relegated to the background because of prosperity. God NEVER said anywhere in His Word that we would be beggars,as long as we maintain our absolute loyalty to Him. And that *loyalty* means obedience.

Observing our evangelical Zion, I note that we are infected with a debilitating virus that was once confined to those living in the world. Our humour reflects what we watch on television. Consequently, we are growing increasingly coarse and sarcastic in responding to those about us. We defend ourselves in such a way that it appears that we no longer recognise the enemy. We seem to believe that anyone who does not agree with us deserves our scorn, or even our rage. James addresses the tendency of Christians to bring into the new life attitudes which should have been left in the world. We will do well to review his words and learn how to root out rot in our lives;

19. Wherefore, my beloved brethren, let every man be swift to hear, slow to speak, slow to wrath:

20. For the wrath of man worketh not the righteousness of God.

21. Wherefore lay apart all filthiness and superfluity of naughtiness, and receive with meekness the engrafted word, which is able to save your souls. (Jas 1: 19-21)

Holiness is a concept that is seemingly absent from contemporary religious life. The holiness that is accepted among the saints(including pastors)appears artificial...a pale, insipid imitation of the real thing.

Our piety is outward; we substitute religious observance for true holiness. The great tragedy of contemporary evangelicals is that we have what has been described as peg-leg religion...we have to strap it on every morning. And we do know that the devil is behind all this and making good use of the opportunity too.

Please allow me to point out some of the observations I make concerning the absence of holiness.

There was a day(a time)when modesty in dress and demeanour was a mark of a young woman’s or a young man’s Christian walk. I know that our grandmothers were somewhat fanatical about their dress, but somehow young women today, to say nothing of many older women, are indistinguishable from the world in their dress sense,(just to belong)!

Perhaps we have forgotten the apostolic admonition that declares, “I desire then that in every place the men should pray, lifting holy hands without anger or quarrelling; likewise also that women should adorn themselves in respectable apparel, with modesty and self-control, not with braided hair and gold or pearls or costly attire, but with what is proper for women who profess godliness—with good works” [1 Timothy 2:8-10]. The Apostle specifically addresses women’s dress, as that is an apparent problem.

But today,right from kindergarten, parents now dress their children in skimpy worldly attire,all in the name of modernism. When these kids grow up like this, what do we expect from them? And I am talking specifically about supposedly Christian parents...whom should be role models.

It doesn't end with dress sense and expression.Neither of these observations immediately addresses the lack of gentleness, the absence of civility, or the apparent delight in harbouring hostility that now appears to mark the lives of many of the professed saints of God. We have seen them fight themselves on the electronic,print and even more on social media. Each with their own group of supporters prepared for any kind of showdown. These supporters/followers worship their pastors and not God. The word of their pastors is usually the truth. God help you if you speak evil of their *daddy* in their presence.

In part, this condition exists and is tolerated, perhaps even fostered, because churches are run like business and congregants generally have a consumer mentality concerning church. Church leaders are too often selected, not on the basis of godliness, but because of their stature in the community, because of their business acumen, according to the size of their portfolio, or by other such criteria that are valued in the world. Congregants are loath to commit themselves to a congregation, and churches are reluctant to hold members accountable to the standards clearly set forth in the Word of God. Attendance at a service is more highly prized than is commitment and submission to the Body of Christ. As result of substituting our own values for godly values, we seldom witness church bodies that are regenerate. What we do witness are churches that are run like business with application of the latest psychological techniques to continue to “grow” the church.

Pastors are chosen to be administrators instead of being shepherds charged with the ministry of the Word, protecting the flock, oversight of the church, pastoring the people and providing an example in godliness. Consequently, congregations are often ignorant of the Word and of the will of God, and they are frequently unruly in their deportment and conduct. However, Christians usually feel good about themselves, primarily because they are not held accountable for their behaviour and because they see their own behaviour as good as or better than that of the pastor.

What a tragedy!!! And the devil is gloating over the disaster...but not for long will he gloat, because IT'S BIBLE PROPHECY PLAYING OUT. The most important thing is to be caught on the right side;

3. For the time will come when they will not endure sound doctrine; but after their own lusts shall they heap to themselves teachers, having itching ears;

4. And they shall turn away their ears from the truth, and shall be turned unto fables. (2Ti 4: 3-4)

But on which side do we wish to be found...the Lord's side or the devil's side?

We still have more on this coming by His Grace and Mercy, Amen 🙇🙏!