Today’s Threading Activity

I just created a

#threadstorm on leofinance.io about the current zealy.io campaign. In my initial post, I accepted my lack of knowledge about what is going on. Thanks to the article of @libertycrypto27 that helps me in my decision. If I would have waited first to completely understand a thing before taking any action, I think nothing will happen.

I started the first two days of May not knowing exactly what to do. I logged in on zealy.io and tried to figure out what to do. I had a good start with the help of easy to understand guide like the idea of “Calendar Threading.”

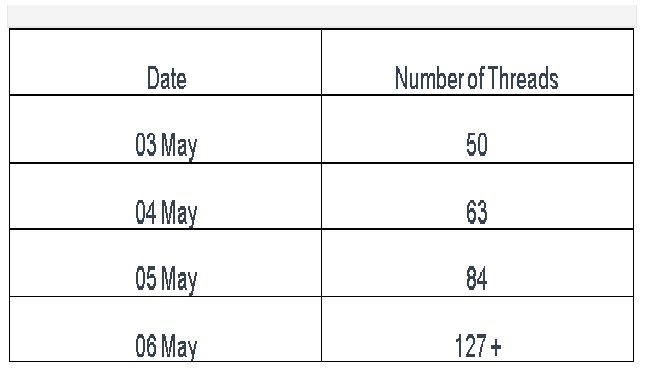

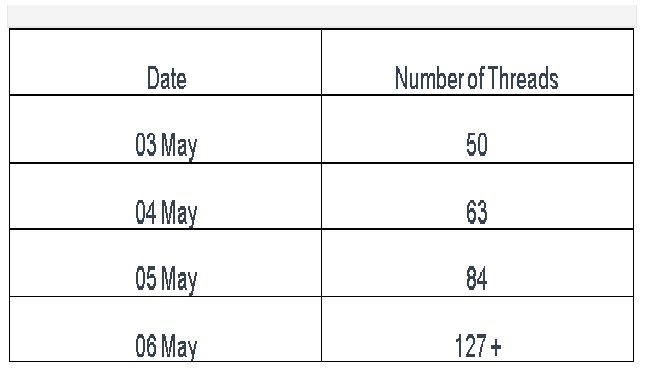

Today is 06 May. We still have thirty-five more days in this campaign. I just read in today’s threads about Hivers joining for the first time and asking if they can still catch up. Of course, the earlier you join and the earlier you understand the mechanics of the campaign, the more it is advantageous to you.

After four days of active threading, I got curious about the significance of what we’re doing as a community. This prompted me to ask a question about the long-term consequences of threading. I am curious about what way creating threads benefits Hive, the LeoFinance Community, and other tribes.

I am impressed with the information provided by the community:

@ifarmgirl-leo quoted @taskmaster4450 saying that more transactions on the blockchain benefit both Hive and its token. She also mentioned that those who participated in the campaign will have an “edge.” I am just not sure of the precise meaning and implication of having such an edge.

@jossduarte thinks that perhaps the team intended to provide a platform for migration for those who are “fed up” with the dominant social media.

@forexbrokr gave the most insightful ideas, and I just want to quote them verbatim:

It's good for the owner of the leofinance.io front-end as more page views mean more ad revenue. If he chooses to drive that ad revenue back into the LEO token, then it will be good for investors.

It's good for Hive because the more users receive a cut of the HIVE rewards pool, the better spread the governance token becomes. This is key for Hive to remain censorship-resistant.

@forexbrokr emphasized the importance of token distribution.

If you will just read the threads during the past four days, you will observe that threaders are having fun with what we do. I responded to one comment saying that though the 10,000.00 USD looks yummy, the fun of participation has its reward by itself. If I can receive even just a tiny portion of that amount, that to me is an additional incentive.

I am learning new things while threading. If there is something I learn from my study of financial literacy, it is the idea that in focusing your energy on something, your primary concern is not just to earn, but to learn. Most people fall under the category of “working to earn” rather than “working to learn.” Of course, it doesn’t mean that if you fall under the second category, you will take monetary incentives for granted. It does mean that you know your priority and that you are building something bigger than the money you can earn short term.

Responding to the insights provided by the members of the community, I thought except for making LeoThreads the communication hub for all of the tribes within the Hive network, all layer two tokens will also benefit from the zealy.io’s existing campaign. I think this is more of an aspiration than an actual description of the status of the tribes using the Hive blockchain. If this will be the case, I think as members of the tribes will realize the potential of the campaign to benefit Hive and all dApps built on it, we will see an explosion in threading numbers. In this sense, we could say that threading is not just a senseless engagement aiming for short-term monetary rewards, but will have a long-term impact on the growth and development of Hive. As such, threading is not a waste of time, but a productive activity. Those who see threading this way will prove it not just by creating threads, but also by meaningfully engaging with other threaders.

Big thanks to @libertycrypto27, @ifarmgirl-leo, @taskmaster4450, @jossduarte, @forexbrokr, and all threaders that I engaged but failed to mention.

Grace and peace!

What is Hive?

What is LeoFinance?

Today’s Threading Activity

I just created a #threadstorm on leofinance.io about the current zealy.io campaign. In my initial post, I accepted my lack of knowledge about what is going on. Thanks to the article of @libertycrypto27 that helps me in my decision. If I would have waited first to completely understand a thing before taking any action, I think nothing will happen.

I started the first two days of May not knowing exactly what to do. I logged in on zealy.io and tried to figure out what to do. I had a good start with the help of easy to understand guide like the idea of “Calendar Threading.”

Today is 06 May. We still have thirty-five more days in this campaign. I just read in today’s threads about Hivers joining for the first time and asking if they can still catch up. Of course, the earlier you join and the earlier you understand the mechanics of the campaign, the more it is advantageous to you.

After four days of active threading, I got curious about the significance of what we’re doing as a community. This prompted me to ask a question about the long-term consequences of threading. I am curious about what way creating threads benefits Hive, the LeoFinance Community, and other tribes.

I am impressed with the information provided by the community:

@ifarmgirl-leo quoted @taskmaster4450 saying that more transactions on the blockchain benefit both Hive and its token. She also mentioned that those who participated in the campaign will have an “edge.” I am just not sure of the precise meaning and implication of having such an edge.

@jossduarte thinks that perhaps the team intended to provide a platform for migration for those who are “fed up” with the dominant social media.

@forexbrokr gave the most insightful ideas, and I just want to quote them verbatim:

It's good for the owner of the leofinance.io front-end as more page views mean more ad revenue. If he chooses to drive that ad revenue back into the LEO token, then it will be good for investors.

It's good for Hive because the more users receive a cut of the HIVE rewards pool, the better spread the governance token becomes. This is key for Hive to remain censorship-resistant.

@forexbrokr emphasized the importance of token distribution.

If you will just read the threads during the past four days, you will observe that threaders are having fun with what we do. I responded to one comment saying that though the 10,000.00 USD looks yummy, the fun of participation has its reward by itself. If I can receive even just a tiny portion of that amount, that to me is an additional incentive.

I am learning new things while threading. If there is something I learn from my study of financial literacy, it is the idea that in focusing your energy on something, your primary concern is not just to earn, but to learn. Most people fall under the category of “working to earn” rather than “working to learn.” Of course, it doesn’t mean that if you fall under the second category, you will take monetary incentives for granted. It does mean that you know your priority and that you are building something bigger than the money you can earn short term.

Responding to the insights provided by the members of the community, I thought except for making LeoThreads the communication hub for all of the tribes within the Hive network, all layer two tokens will also benefit from the zealy.io’s existing campaign. I think this is more of an aspiration than an actual description of the status of the tribes using the Hive blockchain. If this will be the case, I think as members of the tribes will realize the potential of the campaign to benefit Hive and all dApps built on it, we will see an explosion in threading numbers. In this sense, we could say that threading is not just a senseless engagement aiming for short-term monetary rewards, but will have a long-term impact on the growth and development of Hive. As such, threading is not a waste of time, but a productive activity. Those who see threading this way will prove it not just by creating threads, but also by meaningfully engaging with other threaders.

Big thanks to @libertycrypto27, @ifarmgirl-leo, @taskmaster4450, @jossduarte, @forexbrokr, and all threaders that I engaged but failed to mention.

Grace and peace!

What is Hive?

What is LeoFinance?