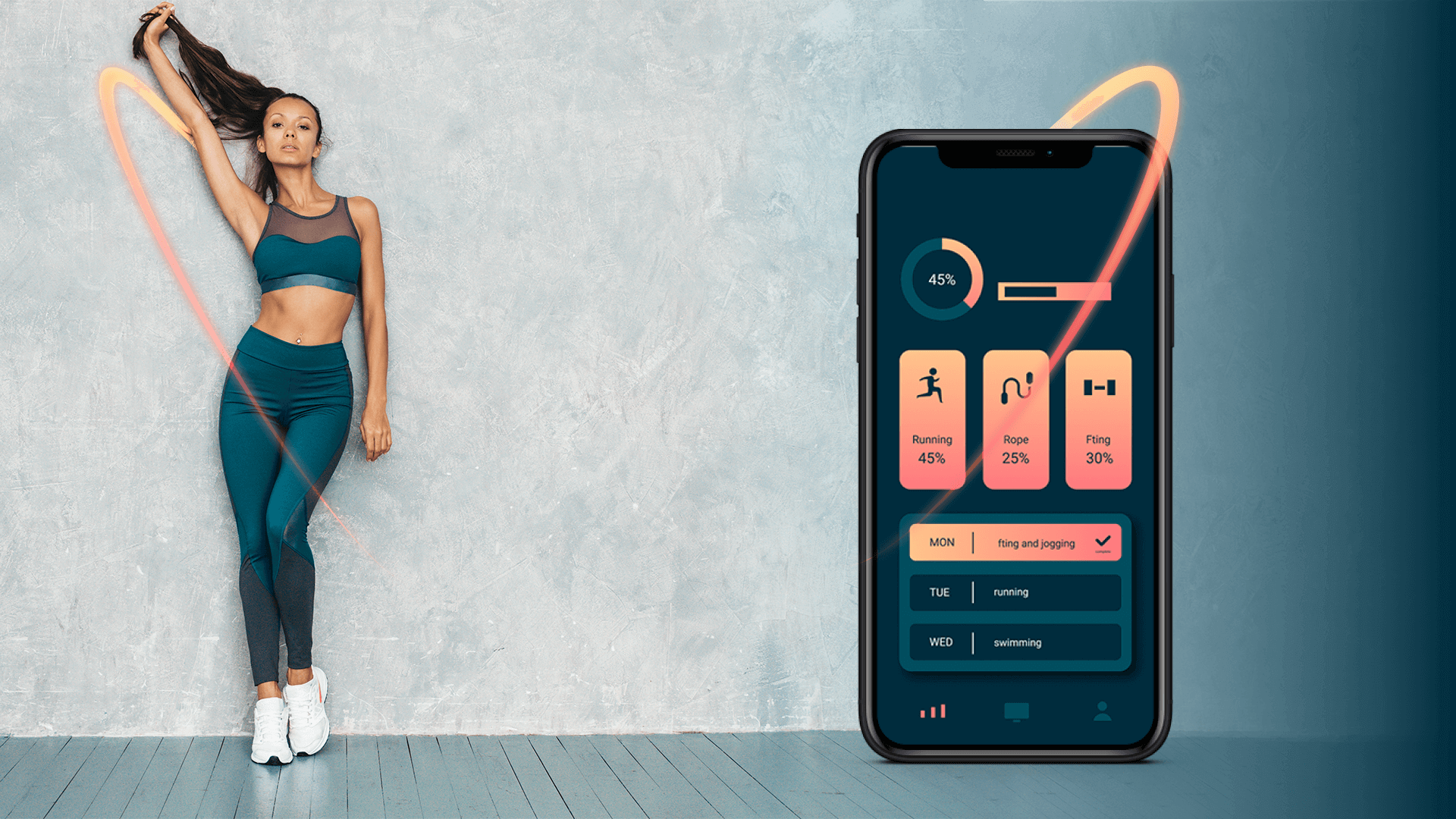

Techugo: Transform Health Experience with Our Fitness App Development Company

Techugo excels as a premier fitness app development company, dedicated to revolutionizing health experiences through innovative digital solutions. With a profound focus on user-centric design and cutting-edge technology, we craft bespoke fitness applications that inspire and empower users worldwide. Our team blends expertise in mobile app development with a passion for fitness to deliver seamless, engaging experiences that promote wellness and lifestyle enhancement. Discover how Techugo transforms health journeys with our unparalleled fitness app solutions.

for more info visit:

https://www.techugo.ca/fitness-app-development

#FitnessAppDevelopmentCompany #appdevelopmentcompanyinCanada #mobileappdevelopmentcompany

Techugo excels as a premier fitness app development company, dedicated to revolutionizing health experiences through innovative digital solutions. With a profound focus on user-centric design and cutting-edge technology, we craft bespoke fitness applications that inspire and empower users worldwide. Our team blends expertise in mobile app development with a passion for fitness to deliver seamless, engaging experiences that promote wellness and lifestyle enhancement. Discover how Techugo transforms health journeys with our unparalleled fitness app solutions.

for more info visit:

https://www.techugo.ca/fitness-app-development

#FitnessAppDevelopmentCompany #appdevelopmentcompanyinCanada #mobileappdevelopmentcompany

Techugo: Transform Health Experience with Our Fitness App Development Company

Techugo excels as a premier fitness app development company, dedicated to revolutionizing health experiences through innovative digital solutions. With a profound focus on user-centric design and cutting-edge technology, we craft bespoke fitness applications that inspire and empower users worldwide. Our team blends expertise in mobile app development with a passion for fitness to deliver seamless, engaging experiences that promote wellness and lifestyle enhancement. Discover how Techugo transforms health journeys with our unparalleled fitness app solutions.

for more info visit:

https://www.techugo.ca/fitness-app-development

#FitnessAppDevelopmentCompany #appdevelopmentcompanyinCanada #mobileappdevelopmentcompany

0 Comments

0 Shares

35 Views