Determining whether a cryptocurrency has a real project or if it is some kind of scam requires some research and analysis. Here are some steps that can help you evaluate a cryptocurrency project:

Team background check: Check the background and experience of the developer team and those responsible for the project. Do they have a successful track record in the field? Do they display their identities publicly?

Project documents (Whitepaper): Read the official documents of the project (Whitepaper) to understand the nature of cryptocurrency, the technology on which it is based, and its purpose. The document must be clear and comprehensive.

Partnerships and Collaborations: Check if the cryptocurrency has collaborated with trusted companies or institutions. Partnerships may indicate the credibility of the project.

Community and Support: Examine the size of the community surrounding cryptocurrency. Is there great interest and support from investors and developers?

Time History: Check the cryptocurrency's history and past performance. Has she achieved previous successes? Are there previous security or technical problems?

Transparency: The project must be transparent about its plans and use of investor funds.

Network Verification: Use search engines to verify news and opinions about cryptocurrency. Problems or warnings may arise if there is disagreement.

Market forecasting: Try to evaluate the realism and feasibility of a future currency project based on current economic and technical conditions.

Remember that fraudulent projects can appear subtle, so you should be careful and use reliable sources when evaluating any cryptocurrency.

Team background check: Check the background and experience of the developer team and those responsible for the project. Do they have a successful track record in the field? Do they display their identities publicly?

Project documents (Whitepaper): Read the official documents of the project (Whitepaper) to understand the nature of cryptocurrency, the technology on which it is based, and its purpose. The document must be clear and comprehensive.

Partnerships and Collaborations: Check if the cryptocurrency has collaborated with trusted companies or institutions. Partnerships may indicate the credibility of the project.

Community and Support: Examine the size of the community surrounding cryptocurrency. Is there great interest and support from investors and developers?

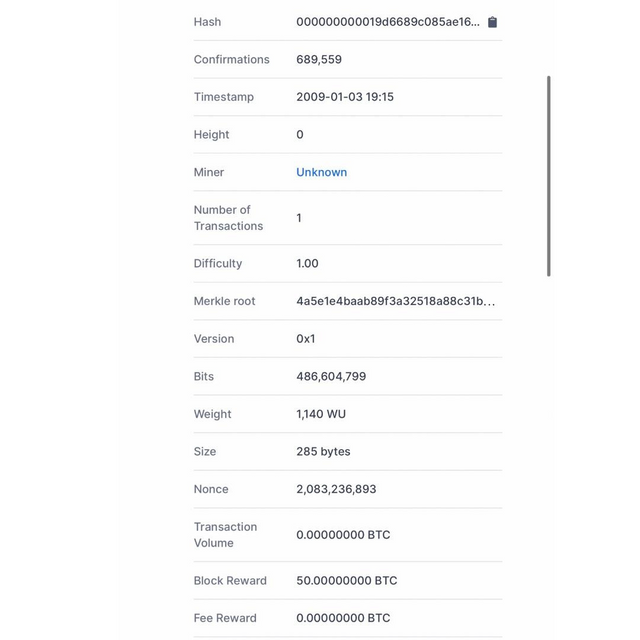

Time History: Check the cryptocurrency's history and past performance. Has she achieved previous successes? Are there previous security or technical problems?

Transparency: The project must be transparent about its plans and use of investor funds.

Network Verification: Use search engines to verify news and opinions about cryptocurrency. Problems or warnings may arise if there is disagreement.

Market forecasting: Try to evaluate the realism and feasibility of a future currency project based on current economic and technical conditions.

Remember that fraudulent projects can appear subtle, so you should be careful and use reliable sources when evaluating any cryptocurrency.

Determining whether a cryptocurrency has a real project or if it is some kind of scam requires some research and analysis. Here are some steps that can help you evaluate a cryptocurrency project:

Team background check: Check the background and experience of the developer team and those responsible for the project. Do they have a successful track record in the field? Do they display their identities publicly?

Project documents (Whitepaper): Read the official documents of the project (Whitepaper) to understand the nature of cryptocurrency, the technology on which it is based, and its purpose. The document must be clear and comprehensive.

Partnerships and Collaborations: Check if the cryptocurrency has collaborated with trusted companies or institutions. Partnerships may indicate the credibility of the project.

Community and Support: Examine the size of the community surrounding cryptocurrency. Is there great interest and support from investors and developers?

Time History: Check the cryptocurrency's history and past performance. Has she achieved previous successes? Are there previous security or technical problems?

Transparency: The project must be transparent about its plans and use of investor funds.

Network Verification: Use search engines to verify news and opinions about cryptocurrency. Problems or warnings may arise if there is disagreement.

Market forecasting: Try to evaluate the realism and feasibility of a future currency project based on current economic and technical conditions.

Remember that fraudulent projects can appear subtle, so you should be careful and use reliable sources when evaluating any cryptocurrency.

0 Comments

0 Shares

5641 Views