AltSignals (ASI) outlook amid expert’s “huge” Bitcoin (BTC) prediction

AltSignals (ASI) recently listed on crypto DEX platform Uniswap.

Analysts have shared major predictions for Bitcoin (BTC) as price hovers near $51k.

As Bitcoin bulls struggle to hold prices above $51k, a crypto analyst has shared a potential bearish flip that could see BTC price trade to $48k. Here’s the price outlook for AltSignals.

BTC price to $48k? Analyst points to on-chain metric

Bitcoin price rose to above $53k on February 20, hitting the highest level since December 2021. While the bellwether cryptocurrency’s market cap remains above the $1 trillion mark hit this month, prices have revisited the $50.6k level on multiple occasions.

A crypto analyst has shared a Bitcoin price prediction suggesting BTC could dip to lows of $48k. On-chain and data analytics platform CryptoQuant shared the analyst’s view on X on Monday.

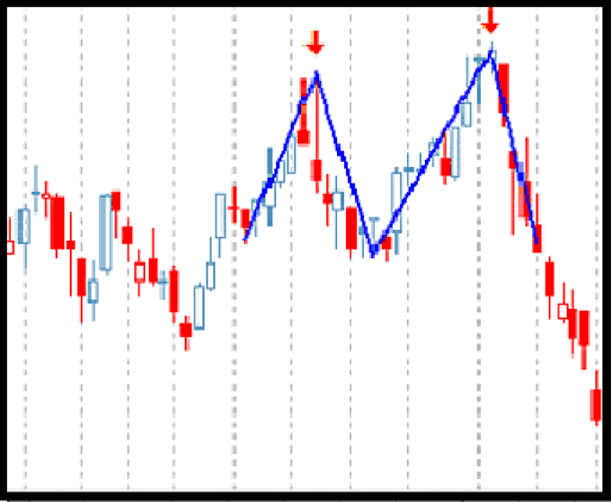

Per the prediction, the 30-day moving average of Bitcoin’s short term Holder SORP metric shows it’s near the selling zone for short-term investors. The technical chart also shows BTC trading below the resistance, with a breakdown likely to push prices to the $48k area.

On the other hand, crypto analyst Ali says Bitcoin could retest the $53k level and target $60.5k amid its megaphone pattern formed on the daily chart.

What could this mean for the altcoin market, for AltSignals price? Largely, declines for Bitcoin have seen the broader market react lower.

Likewise, a mega rally has often injected new upside momentum in altcoins, likely to be led by ETH as spot Ethereum ETF excitement builds up. A recent report showed 84% of crypto investors see Bitcoin hitting a new all-time high in 2024.

AltSignals: Trading signals enhanced by AI

AltSignals has consistently returned win rates averaging 64%. Traders have benefitted from thousands of signals across stocks, crypto and forex among other markets.

With business on the upside since its debut in 2017, this trading signals platform is now getting ready for the next chapter of growth. It seeks to capitalize on the Artificial Intelligence (AI) boom by integrating a new AI stack dubbed ActualizeAI.

The platform aims to increase its algorithm’s average win rate from 64% to over 80%.

Elsewhere, the AltSignals roadmap includes the licensing of ActualizeAI and launch of Actualize Pass NFT marketplace. There are also plans to partner with other platforms to enhance adoption.

The native token is ASI, which offers holders access to the AI ecosystem.

AltSignals price prediction: Will ASI token explode 2024?

The ASI token recently listed on the decentralized exchange (DEX) platform Uniswap, having successfully navigated its presale that closed in December last year.

As the AI narrative strengthens and crypto markets expand, AltSignals (ASI) looks primed to be one of the top investing opportunities in the market. In the short term, a dip across the market may see ASI token struggle too.

If the market rallies as anticipated amid Bitcoin’s halving and other tailwinds, the value of ASI could rise significantly. The potential for the AltSignals’ price to 100x is there given the likely demand for ActualizeAI.

https://token.altsignals.io/

AltSignals (ASI) recently listed on crypto DEX platform Uniswap.

Analysts have shared major predictions for Bitcoin (BTC) as price hovers near $51k.

As Bitcoin bulls struggle to hold prices above $51k, a crypto analyst has shared a potential bearish flip that could see BTC price trade to $48k. Here’s the price outlook for AltSignals.

BTC price to $48k? Analyst points to on-chain metric

Bitcoin price rose to above $53k on February 20, hitting the highest level since December 2021. While the bellwether cryptocurrency’s market cap remains above the $1 trillion mark hit this month, prices have revisited the $50.6k level on multiple occasions.

A crypto analyst has shared a Bitcoin price prediction suggesting BTC could dip to lows of $48k. On-chain and data analytics platform CryptoQuant shared the analyst’s view on X on Monday.

Per the prediction, the 30-day moving average of Bitcoin’s short term Holder SORP metric shows it’s near the selling zone for short-term investors. The technical chart also shows BTC trading below the resistance, with a breakdown likely to push prices to the $48k area.

On the other hand, crypto analyst Ali says Bitcoin could retest the $53k level and target $60.5k amid its megaphone pattern formed on the daily chart.

What could this mean for the altcoin market, for AltSignals price? Largely, declines for Bitcoin have seen the broader market react lower.

Likewise, a mega rally has often injected new upside momentum in altcoins, likely to be led by ETH as spot Ethereum ETF excitement builds up. A recent report showed 84% of crypto investors see Bitcoin hitting a new all-time high in 2024.

AltSignals: Trading signals enhanced by AI

AltSignals has consistently returned win rates averaging 64%. Traders have benefitted from thousands of signals across stocks, crypto and forex among other markets.

With business on the upside since its debut in 2017, this trading signals platform is now getting ready for the next chapter of growth. It seeks to capitalize on the Artificial Intelligence (AI) boom by integrating a new AI stack dubbed ActualizeAI.

The platform aims to increase its algorithm’s average win rate from 64% to over 80%.

Elsewhere, the AltSignals roadmap includes the licensing of ActualizeAI and launch of Actualize Pass NFT marketplace. There are also plans to partner with other platforms to enhance adoption.

The native token is ASI, which offers holders access to the AI ecosystem.

AltSignals price prediction: Will ASI token explode 2024?

The ASI token recently listed on the decentralized exchange (DEX) platform Uniswap, having successfully navigated its presale that closed in December last year.

As the AI narrative strengthens and crypto markets expand, AltSignals (ASI) looks primed to be one of the top investing opportunities in the market. In the short term, a dip across the market may see ASI token struggle too.

If the market rallies as anticipated amid Bitcoin’s halving and other tailwinds, the value of ASI could rise significantly. The potential for the AltSignals’ price to 100x is there given the likely demand for ActualizeAI.

https://token.altsignals.io/

AltSignals (ASI) outlook amid expert’s “huge” Bitcoin (BTC) prediction

AltSignals (ASI) recently listed on crypto DEX platform Uniswap.

Analysts have shared major predictions for Bitcoin (BTC) as price hovers near $51k.

As Bitcoin bulls struggle to hold prices above $51k, a crypto analyst has shared a potential bearish flip that could see BTC price trade to $48k. Here’s the price outlook for AltSignals.

BTC price to $48k? Analyst points to on-chain metric

Bitcoin price rose to above $53k on February 20, hitting the highest level since December 2021. While the bellwether cryptocurrency’s market cap remains above the $1 trillion mark hit this month, prices have revisited the $50.6k level on multiple occasions.

A crypto analyst has shared a Bitcoin price prediction suggesting BTC could dip to lows of $48k. On-chain and data analytics platform CryptoQuant shared the analyst’s view on X on Monday.

Per the prediction, the 30-day moving average of Bitcoin’s short term Holder SORP metric shows it’s near the selling zone for short-term investors. The technical chart also shows BTC trading below the resistance, with a breakdown likely to push prices to the $48k area.

On the other hand, crypto analyst Ali says Bitcoin could retest the $53k level and target $60.5k amid its megaphone pattern formed on the daily chart.

What could this mean for the altcoin market, for AltSignals price? Largely, declines for Bitcoin have seen the broader market react lower.

Likewise, a mega rally has often injected new upside momentum in altcoins, likely to be led by ETH as spot Ethereum ETF excitement builds up. A recent report showed 84% of crypto investors see Bitcoin hitting a new all-time high in 2024.

AltSignals: Trading signals enhanced by AI

AltSignals has consistently returned win rates averaging 64%. Traders have benefitted from thousands of signals across stocks, crypto and forex among other markets.

With business on the upside since its debut in 2017, this trading signals platform is now getting ready for the next chapter of growth. It seeks to capitalize on the Artificial Intelligence (AI) boom by integrating a new AI stack dubbed ActualizeAI.

The platform aims to increase its algorithm’s average win rate from 64% to over 80%.

Elsewhere, the AltSignals roadmap includes the licensing of ActualizeAI and launch of Actualize Pass NFT marketplace. There are also plans to partner with other platforms to enhance adoption.

The native token is ASI, which offers holders access to the AI ecosystem.

AltSignals price prediction: Will ASI token explode 2024?

The ASI token recently listed on the decentralized exchange (DEX) platform Uniswap, having successfully navigated its presale that closed in December last year.

As the AI narrative strengthens and crypto markets expand, AltSignals (ASI) looks primed to be one of the top investing opportunities in the market. In the short term, a dip across the market may see ASI token struggle too.

If the market rallies as anticipated amid Bitcoin’s halving and other tailwinds, the value of ASI could rise significantly. The potential for the AltSignals’ price to 100x is there given the likely demand for ActualizeAI.

https://token.altsignals.io/