How to search for new airdrops? ????

â €

Today we decided to do a more professional post that not everyone can understand. But we tried to keep it as simple as possible. Learn, apply and make money!

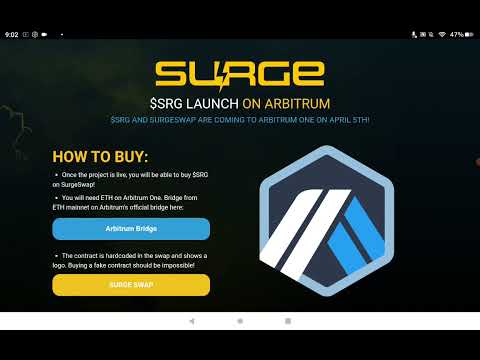

âž¡ï¸ A couple of weeks ago a medium-styled drophunter (a person who deals with airdrop) took about $3,000-4,000 from an Arbitrum drop. The story instantly went viral on the internet, and interest in the topic of airdrop has multiplied. The big question: how do you find new drops?

The first solution is to track the activities of drop hunters. These are people and teams who are constantly searching for new drops, participating in all sorts of activities and getting tokens for it.

Any crypto is based on a blockchain, and all transactions recorded in it can be tracked. Below are a few cryptocurrency wallets associated with drop hunters. You can use them to track the activities that the experienced guys are involved in.

âž¡ï¸ Drophunters crypto wallets:

1ï¸âƒ£0x6f9bb7e454f5b3eb2310343f0e99269dc2bb8a1d

2ï¸âƒ£0x11B1785D9Ac81480c03210e89F1508c8c115888E

3ï¸âƒ£0x70e7a6621f4cb3c3e073d0539899f49fc88424c0

4ï¸âƒ£0x78Ebe56BC138069557C89af35EB29023fF31Ae2c

5ï¸âƒ£0x000f4432a40560bbff1b581a8b7aded8dab80026

6ï¸âƒ£0xd56EE5Ba5A52e15f309108BDd6247C69B4F624C2

What to do with all this? Track transactions and study the smart contracts the wallets interact with. Based on that, you can figure out what drops they are involved in.

An example of a tracking service is Etherscan and BscScan.

For example, if wallets connect to StarkNet and use certain swappers (swap tokens), that's a signal for action.

â†ªï¸ Another important indicator is the interaction with contracts without tokens. This is a harbinger of drop. If you find such activity, dig further and try to replicate the actions of the drop hunter's wallet.

Put ???? if you would like to see more similar content - more professional.

#somee#bitcoin#airdrops#

How to search for new airdrops? ????

â €

Today we decided to do a more professional post that not everyone can understand. But we tried to keep it as simple as possible. Learn, apply and make money!

âž¡ï¸ A couple of weeks ago a medium-styled drophunter (a person who deals with airdrop) took about $3,000-4,000 from an Arbitrum drop. The story instantly went viral on the internet, and interest in the topic of airdrop has multiplied. The big question: how do you find new drops?

The first solution is to track the activities of drop hunters. These are people and teams who are constantly searching for new drops, participating in all sorts of activities and getting tokens for it.

Any crypto is based on a blockchain, and all transactions recorded in it can be tracked. Below are a few cryptocurrency wallets associated with drop hunters. You can use them to track the activities that the experienced guys are involved in.

âž¡ï¸ Drophunters crypto wallets:

1ï¸âƒ£0x6f9bb7e454f5b3eb2310343f0e99269dc2bb8a1d

2ï¸âƒ£0x11B1785D9Ac81480c03210e89F1508c8c115888E

3ï¸âƒ£0x70e7a6621f4cb3c3e073d0539899f49fc88424c0

4ï¸âƒ£0x78Ebe56BC138069557C89af35EB29023fF31Ae2c

5ï¸âƒ£0x000f4432a40560bbff1b581a8b7aded8dab80026

6ï¸âƒ£0xd56EE5Ba5A52e15f309108BDd6247C69B4F624C2

What to do with all this? Track transactions and study the smart contracts the wallets interact with. Based on that, you can figure out what drops they are involved in.

An example of a tracking service is Etherscan and BscScan.

For example, if wallets connect to StarkNet and use certain swappers (swap tokens), that's a signal for action.

â†ªï¸ Another important indicator is the interaction with contracts without tokens. This is a harbinger of drop. If you find such activity, dig further and try to replicate the actions of the drop hunter's wallet.

Put ???? if you would like to see more similar content - more professional.

#somee#bitcoin#airdrops#